According to the USDA-FAS Gain Report, Ch-2021-0027 released on March 3rd, China will produce 650 million hogs in 2021 up from 440 million in 2019. In 2021, China will slaughter 598 million hogs and will maintain a sow herd of 42 million. Despite progress in the suppression of African swine fever, production in 2021 will be lower than in 2017, before the advent of the infection.

According to the USDA-FAS Gain Report, Ch-2021-0027 released on March 3rd, China will produce 650 million hogs in 2021 up from 440 million in 2019. In 2021, China will slaughter 598 million hogs and will maintain a sow herd of 42 million. Despite progress in the suppression of African swine fever, production in 2021 will be lower than in 2017, before the advent of the infection.

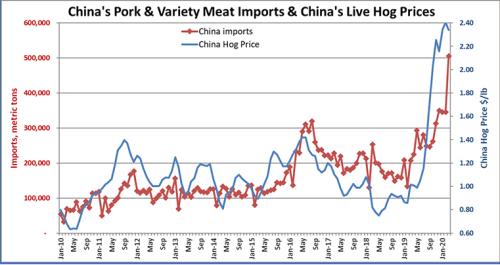

For calendar 2021, China will produce 47 million metric tons of pork, approximately 23 percent more than in 2020. Imports of chilled and frozen pork will attain 4.5 million metric tons, representing 8.8 percent of total domestic consumption of 51.4 million tons. Given a population of 1.4 billion, per capita consumption corresponds to 81 pounds. The increase in production over the past two years, despite endemic African swine fever has been achieved through a sharp transition from small family units to large integrated facilities capable of imple menting effective biosecurity. (see image, bottom right). Large producers received loans from local and municipal governments to expand production. Further growth in production will be limited by ongoing African swine fever and the relatively low productivity of sows due to alterations made in selection and breeding programs to maximize piglet production.

menting effective biosecurity. (see image, bottom right). Large producers received loans from local and municipal governments to expand production. Further growth in production will be limited by ongoing African swine fever and the relatively low productivity of sows due to alterations made in selection and breeding programs to maximize piglet production.

The increased supply of pork has reduced retail prices that remain high relative to the pre-ASF year of 2017. The U.S. exported 696,000 metric tons of frozen pork to China in 2020 up from 245,000 metric tons in 2019. In 2020, the U.S. represented 16 percent of the total of imports of 4.3 million metric tons from all supplying nations. Collectively the E.U. supplied 47 percent of import volume with Brazil shipping 11.2 percent of the imported volume.

Recovery of domestic pork production in China will have repurcussions in the U.S. More hogs processed in China will increase demand for corn and soybeans raising U.S domestic broiler and egg costs. Greater availability of pork at lower prices in China will reduce demand for broiler meat depressing the need for bone-in broiler exports from Brazil and the U.S.

Recovery of domestic pork production in China will have repurcussions in the U.S. More hogs processed in China will increase demand for corn and soybeans raising U.S domestic broiler and egg costs. Greater availability of pork at lower prices in China will reduce demand for broiler meat depressing the need for bone-in broiler exports from Brazil and the U.S.