In a press release dated August 4th Beyond Meat Inc. (BYND) announced results for the 2nd Quarter of FY 2022 ending July 2nd. The Company disappointed on the top line with sales of $147 million against a consensus of $149 million. The bottom line miss was a negative EPS of $1.53 against an expectation of a negative $1.18

The following table summarizes the results for the period compared with the values for the corresponding quarter of the previous fiscal year (Values expressed as US$ x 1,000 except EPS)

|

2nd Quarter Ending

|

July 2nd 2022

|

July 3rd 2021

|

Difference (%)

|

|

Sales:

|

$147,040

|

$149,426

|

-1.6

|

|

Gross profit:

|

$(6,162)

|

$47,352

|

-113

|

|

Operating income:

|

$(89,681)

|

$(18,601)

|

-382

|

|

Pre-tax Income

Net Income / (loss)

|

$(95,691)

$(97,134)

|

$(19,443)

$(19,652)

|

-392

-394

|

|

Diluted earnings per share:

|

$(1.53)

|

$(0.31)

|

-394

|

|

Gross Margin (%)

|

(4.2)

|

31.6

|

-113

|

|

Operating Margin (%)

|

(60.9)

|

(12.2)

|

-399

|

|

Profit Margin (%)

|

(66.1)

|

(13.2)

|

-400

|

|

Long-term Debt and lease obligations:

|

$1,156,523

|

$1,152,715

|

+0.3

|

|

12 Months Trailing:

|

|

Return on Assets (%)

|

-14

|

|

Return on Equity (%)

|

-321

|

|

Operating Margin (%)

|

-65

|

|

Profit Margin (%)

|

-72

|

|

Total Assets July 2nd.

|

$1,218109

|

$1,379,399

|

-11.6

|

|

Market Capitalization August 5th

|

$2,160,000

|

Notes for the 2nd Quarter derived from data presented:

SGA ’22 $63 million comprising 42.8% of sales compared to ’21 $48.3 million or 32.3% of sales

R&D ’22 $16.2 million comprising 11.0% of sales compared to ’21 at $13.8 million or 9.2% of sales

Inventory: In Q2’22 represented 20.9% of sales compared to 17.5% in Q2 2021

In Q2 ’22 30.1 million lbs. sold compared to 26.3 million lbs. in Q2 ‘21

In Q2 ’22 Unit revenue attained $4.88/lb. compared to $5.69/lb. in Q2 2021

In Q2 ’22 each of claimed 183,000 outlets received an average of 165 lbs. product compared to 118,000 outlets receiving 222lbs. in Q2 ‘21

In Q2 2022 U.S sales represented 70 percent of revenue of which 77 percent was retail, the remainder, food service.

In Q2 2022 International sales represented 30 percent of revenue of which 53 percent was retail, the remainder, food service.

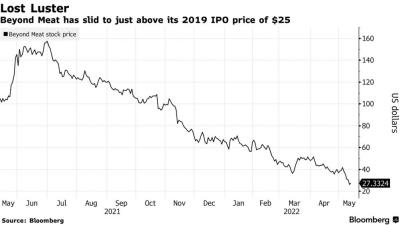

52-Week Range in Share Price: $20.50 to $134.99 50-day Moving average $28.42

Forward P/E 666

In commenting on Q2 2022 results , Ethan Brown Founder and CEO stated, “We recorded our second largest quarter ever in terms of net revenues even as consumers traded down among proteins in the context of inflationary pressures, and we made solid sequential progress on reducing operating and manufacturing conversion costs. Across the balance of the year, we are tightly focused on intensifying OpEx and manufacturing cost reductions, executing against a series of planned market activities for our global strategic partners, and strengthening our retail business through core support and the introduction of one of our best innovations to date. Through these and other measures, we are confident we will emerge from the current economic climate leaner and stronger, and well positioned for our next chapter of growth.”

The report included commentary on the second quarter that included:-

“The decrease in net revenue per pound was primarily attributable to changes in price, including the impact of sales to liquidation channels and list price reductions in the EU implemented in the first quarter of 2022, changes in foreign exchange rates, and increased trade discounts”.

The reality is that the Company record includes:-

- An accumulated deficit of $574.6 million.

- Trailing 12-month operating cash flow of -$416 million

- Effective July 15th 41 percent of float was short

- News reports of mismanagement and failure to execute and deliver on products offered to food service prospects

- Share price off 43 percent year-to-date

Notwithstanding the Q2 report BYND opened August 15th post release at $31.33 and closed inexplicably up 18% at $38.26. Management may attribute this market affirmation to promises to cut expenses by laying off four percent of staff and other economies to reduce cash burn. A more sinister explanation is that some investors see the inevitability of an acquisition with a premium or alternatively a short squeeze in the near future. David Trainer speaking on CNBC correctly points to flagging sales and losses among the manufacturers of vegetable protein with extreme competition in the market. (see Report on Maple Leaf Foods Q2 in this edition). Analysts see Beyond Meat running out of cash with a share price below $5. This will create an opportunity for a Grey or even a Black knight (the White knights have passed it over) to acquire and dismember the Company. Tyson Foods correctly assessed the prospects for Beyond Meat when they disposed of their equity before the IPO.

Notwithstanding the Q2 report BYND opened August 15th post release at $31.33 and closed inexplicably up 18% at $38.26. Management may attribute this market affirmation to promises to cut expenses by laying off four percent of staff and other economies to reduce cash burn. A more sinister explanation is that some investors see the inevitability of an acquisition with a premium or alternatively a short squeeze in the near future. David Trainer speaking on CNBC correctly points to flagging sales and losses among the manufacturers of vegetable protein with extreme competition in the market. (see Report on Maple Leaf Foods Q2 in this edition). Analysts see Beyond Meat running out of cash with a share price below $5. This will create an opportunity for a Grey or even a Black knight (the White knights have passed it over) to acquire and dismember the Company. Tyson Foods correctly assessed the prospects for Beyond Meat when they disposed of their equity before the IPO.