Periodically the U.S. Energy Information Administration (USEIA) issues Short-Term Energy Outlook (STEO) reports. Highlights from the June edition have relevance to the chicken industry that is reliant on energy for all areas of grow-out, processing and distribution.

Periodically the U.S. Energy Information Administration (USEIA) issues Short-Term Energy Outlook (STEO) reports. Highlights from the June edition have relevance to the chicken industry that is reliant on energy for all areas of grow-out, processing and distribution.

The USEIA assumed a 6.7 percent growth in GDP in 2021 following restoration of the economy after COVID restrictions. In 2022 GDP will increase by 4.9 percent.

The major conclusions from the most recent STEO are:

- Brent Crude Oil spot prices that averaged $68 per barrel in May will remain near current levels as production increases to match demand. Brent Crude will average $60 per barrel in 2022.

- Gasoline consumption will increase to 9.1 million barrels per day during summer, approximately 20 percent higher than in 2020. Return to work with commuting and holiday travel will increase consumption to an average of 8.7 million barrels per day for entire 2021 and 9.0 million barrels per day will be consumed in 2022. It must be remembered that the bulk of gasoline used will incorporate 10 percent ethanol with limited uptake of blends higher than 10 percent. For the summer driving season U.S. regular gasoline will retail at an average of $2.92 per gallon reflecting higher crude oil prices and margins. For entire 2021 U.S. regular gasoline price will average $2.77 and households will spend approximately one-third more on fuel in 2021 compared to 2020.

- The Henry Hub spot price for natural gas will average $2.92 per million Btu in the third quarter of 2021 and will average $3.07 for entire 2021. Increases in 2021 are attributed to high natural gas exports and increased consumption.

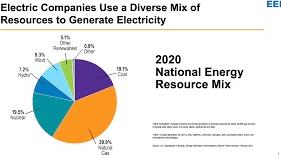

- Electricity demand in the U.S. will increase by 2.3 percent in 2021 after a fall of 4 percent in 2020. Colder temperatures during the first quarter of 2021 increased domestic consumption. With the increase in the price of natural gas and higher demand for electrical power it is projected that the proportion generated from natural gas will decline from 39 percent in 2020 to 36 percent in 2021 and 35 percent in 2022.

- Coal production will increase in 2021 due partly to exports but also higher demand for electrical power. Generation from coal will rise from 20 percent in 2020 to 23 percent in 2021 and to 23 percent in 2022. In contrast nuclear generation will decline by 1 percent to a level of 20 percent of electrical generation in 2021.

- Wind and solar generating capacity will increase in 2021 with large-scale solar projects in western states and wind generation increasing by 16.0 GW in 2021 from Midwest and plains states.

- The decline in power generation in 2020 resulted in reduced carbon dioxide emissions. As the economy recovers, emissions will increase about six percent from the 2020 level followed by a two percent incremental rise in 2022.

The bottom line is that fuel and power costs depending on area and source will be approximately four to five percent higher in 2021 compared to the previous year.