Editorial

|

Balance Between Pre-election Rhetoric and Outcomes

or You Can’t Have It Both Ways!

|

|

It is evident that the incoming Administration of President Donald J. Trump will attempt to implement many of the pre-election promises early during the coming term of office. The principal policies will revolve around deportation of illegal immigrants and improving the financial wellbeing of citizens. These objectives will establish conflicts that have a direct bearing on agriculture and hence the availability and price of food. Apparent conflicts will have to be resolved by concessions made by both sides of the aisle in the 119th Congress. Legislators holding extreme positions on the left and right will be forced to moderate their entrenched positions in the interests of the nation. It is evident that the incoming Administration of President Donald J. Trump will attempt to implement many of the pre-election promises early during the coming term of office. The principal policies will revolve around deportation of illegal immigrants and improving the financial wellbeing of citizens. These objectives will establish conflicts that have a direct bearing on agriculture and hence the availability and price of food. Apparent conflicts will have to be resolved by concessions made by both sides of the aisle in the 119th Congress. Legislators holding extreme positions on the left and right will be forced to moderate their entrenched positions in the interests of the nation.

Potential conflict areas include:

- Tariffs raise the prospects of trade wars. If the Administration imposes tariffs on our two USMCA partners, in addition to the E.U. and especially China, trade will be impacted by countervailing punitive action. This will reduce exports and disturb the equilibrium between domestic supply and demand. Prices for major agricultural commodities including corn and soybeans will fall to the advantage of livestock producers but will seriously reduce the earnings of row-crop farmers.

- Deportation of nondocumented agricultural workers will reduce the availability of labor and increase the cost of production. This will be passed onto consumers and will run counter to the promise to reduce family expenditure on food.

- Relaxation of environmental, health, financial and other regulations will facilitate expansion of some agricultural operations. Advantages may however be offset by fraud, a decline in food safety standards and environmental degradation.

- Reversal of climate remediation will be counterproductive. Progress has been made in reducing greenhouse gas emissions by adopting solar and wind generation of electrical power displacing fossil fuels. Encouraging greater use of petroleum products through a “drill-baby-drill” approach may be both impractical and ultimately costly. Global warming is contributing to the frequency and intensity of hurricanes and other weather extremes imposing high costs for response and repair of damage. Reversing progress in clean energy through restricting wind, solar and nuclear generation would be to the medium- and long-term detriment of our economy and health in the U.S.

- Reducing government expenditure by as much as $2 trillion annually would require extensive reductions in social security and Medicaid benefits. Although preventive medicine will ultimately reduce the cost of treatment of chronic conditions, benefits would only accrue in future decades, but the pain would be borne in the immediate term.

- Increasing farm support would appear necessary following a trade war characterised by reduced exports, increased costs for labor and the inevitable restoration of inflation predicated by a program of tariffs. This would require an increase in the national debt that is antithetical to conservative values.

Radical solutions to current problems will have unintended consequences. The move towards isolation as exemplified by the Smoot-Hawley Tariff Act of 1930 effectively precipitated the great depression over the third decade of the previous century. Farmers were the most impacted segment of the economy resulting in profound demographic changes in our population. Despite improved efficiency in the agricultural sector through consolidation and mechanization, both cost and revenue will be adversely affected by inappropriate and imprudent policy decisions.

It is hoped that bipartisanship and sound economic policies will prevail in the coming administration and 119th Congress and that extreme pre-electoral rhetoric and promises will be modulated in the interests of wellbeing of our citizenry and long-term growth of the economy.

|

|

Poultry Industry News

|

Besco Special

|

|

Introduction

This special focus edition is sponsored by Besco Structures. On June 15th, Agricon LLC announced their rebranding to become Besco Structures. This emphasizes the company mission to provide engineered steel buildings incorporating quality, durability and innovation for a broad range of applications including agriculture.

Mark Doyle, Director of Besco Structures stated, “While our name has changed our commitment to excellence remains steadfast.” The new name represents a broader scope and represents the company expertise in delivering engineered buildings. Mark Doyle, Director of Besco Structures stated, “While our name has changed our commitment to excellence remains steadfast.” The new name represents a broader scope and represents the company expertise in delivering engineered buildings.

Besco Structures will continue the service and expertise in engineering and execution associated with Agricon LLC in both the domestic and international markets.

Specific services to be offered by Besco Structures will include:

- Custom design and engineering

- Manufacturing structural components to precise specifications

- Prompt delivery of building components with ease of erection

- Comprehensive customer support

In commenting on the change in name from Agricon, Brian Steffen, CEO of the Bahler Group, the holding company stated, “This rebranding is a testament to our ongoing commitment to providing our customers with the best possible products and service. We are confident that Besco Structures will become the industry standard for excellence in steel buildings for agriculture in addition to a wide range of industries.”

|

Meat Projection June 2025

|

|

Updated USDA-ERS Poultry Meat Projection for December 2024. Updated USDA-ERS Poultry Meat Projection for December 2024.

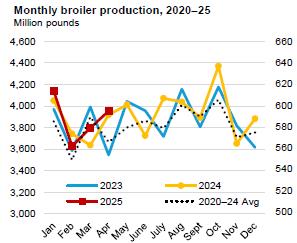

On June 18th 2024 the USDA-Economic Research Service released updated production and consumption data with respect to broilers and turkeys, covering 2024, a projection for 2025 and a forecast for 2026.

The 2025 projection for broiler production is for 47,500 million lbs. (21.591 million metric tons) up 1.2 percent from 2024. USDA projected per capita consumption of 101.9 lbs. (46.3 kg.) for 2025, up 0.9 percent from 2024. Exports will attain 6,588 million lbs. (2.995 million metric tons), 2.0 percent below the previous year.

The 2026 USDA forecast for broiler production will be 48,100 million lbs. (21.864 million metric tons) up 1.1 percent from 2025 with per capita consumption up 0.7 lb. to 102.6 lbs. (46.6 kg). Exports will be 1.2 percent higher compared to 2025 at 6,670 million lbs. (3.031 million metric tons), equivalent to 14.5 percent of production.

Production values for the broiler and turkey segments of the U.S. poultry meat industry are tabulated below:-

|

Parameter

|

2024

(actual)

|

2025

(projection)

|

2026

(forecast)

|

Difference

2024 to 2025

|

|

Broilers

|

|

|

|

|

|

Production (million lbs.)

|

46,994

|

47,580

|

48,100

|

+1.2

|

|

Consumption (lbs. per capita)

|

101.0

|

101.9

|

102.6

|

+0.9

|

|

Exports (million lbs.)

|

6,724

|

6,588

|

6,670

|

-2.0

|

|

Proportion of production (%)

|

14.3

|

13.8

|

13.9

|

-3.5

|

|

|

|

|

|

|

|

Turkeys

|

|

|

|

|

|

Production (million lbs.)

|

5,121

|

4,806

|

5,080

|

-6.2

|

|

Consumption (lbs. per capita)

|

13.8

|

13.0

|

13.5

|

-5.8

|

|

Exports (million lbs.)

|

486

|

405

|

435

|

-16.7

|

|

Proportion of production (%)

|

9.5

|

8.4

|

8.6

|

-11.6

|

Source: Livestock, Dairy and Poultry Outlook released June 18th 2025

The June USDA report updated projection for the turkey industry for 2025 including annual production of 4,806 million lbs. (2.185 million metric tons), down 6.2 percent from 2024. Consumption in 2025 is projected to be 13.0 lbs. (5.9 kg.) per capita, down proportionately by 5.8 percent from the previous year. Export volume will attain 405 million lbs. (184,090 metric tons) in 2025. Values for production and consumption of RTC turkey in 2025 are considered to be realistic, given year to date data, the prevailing economy, variable weekly poult placements, production levels, reduced losses from HPAI and inventories consistent with season.

The 2026 forecast for turkey production is 5,080 million lbs. (2.309 million metric tons) up an optimistic 5.7 percent from 2025 with per capita consumption up an unsubstantiated 3.8 percent to 13.5 lbs. (6.1 kg). Exports will be 19.7 percent higher than in 2025 to 435 million lbs. (197,728 metric tons) equivalent to 8.6 percent of production.

Export projections do not allow for a breakdown in trade relations with existing major partners including Mexico, Canada and China nor the impact of catastrophic diseases including HPAI and vvND in either the U.S. or importing nations

|

Besco Structures is Committed to Client Satisfaction

|

|

Besco Structures has integrated design engineering, procurement, construction, project management and service into a cohesive model contributing to client satisfaction. Besco is ISO 9001: 2015 certified and is qualified by experience and resources to undertake retrofits, additional buildings and greenfield projects for poultry housing, hatcheries, packing and processing plants, feed mills and ancillary buildings

- Design engineers review client requirements through a process of active listening and interaction with regard to an immediate project and for future expansion. This contributes to establishing specifications for buildings to achieve optimal flock performance over the long term.

- Besco Structures has available the services of external consultants to compliment the comprehensive experience gained in completing projects in the U.S., France, Poland, Malaysia, Brazil, China and the Philippines.

- Besco Structures is committed to meticulous engineering standards to develop solutions through collaboration among clients, vendors and erectors. All designs developed by Besco Structures comply with IBC and Eurocode standards and will conform to regional laws and local ordinances. In designing projects Besco engineers consider environmental factors including seismic loads, climatic extremes including snow load, wind force and the topography of a selected site to ensure long-term structural integrity.

- The sourcing and purchasing expertise within Besco Structures contributes to securing quality materials at competitive prices that are reflected in the capital cost of projects whether individual houses or multi-building complexes.

- With current concerns over fires in both recently constructed and older buildings, Besco designs flame-resistance into all structures. Besco buildings are constructed of steel and incorporate insulated metal panels that resist fire. Individual components that may be damaged in a fire or a climatic event can be removed and replaced. A fire in a conventional house erected with wooden structural components and flammable panels usually results in a total loss of the building. Steel structures and non-flammable panels mitigate fire damage and allow repair and replacement of equipment and installations limiting business interruption by reducing the time required to resume production.

- Experience gained in four continents ensures timely delivery and adherence to predetermined completion dates consistent with the biological cycle of flock placement.

Projects completed by Agricon before re-branding as Besco Structures |

- Besco construction teams provide on-site management for projects extending from sequenced delivery of components to final handover and commissioning. Besco Structures delivers buildings with high standards of quality and craftsmanship reducing the need for subsequent modifications and refits and minimizing expenditure on future maintenance.

The Besco Structures approach to engineering, planning and execution is integral to the promise of enduring performance.

|

Broiler Month

|

|

Monthly Broiler Production Statistics, May 2024.

Broiler Chick Placements May-June 2025.

According to the June 18th 2025 USDA Broiler Hatchery Report, 1.260 million eggs were set over five weeks extending from May 17th 2025 through June14th 2025 inclusive. This was 1.2 percent higher compared to the corresponding period in 2024.

Total chick placements for the U.S. over the five-week period amounted to 967.67 million chicks. Claimed hatchability for the period averaged 79.1 percent for eggs set three weeks earlier. Each 1.0 percent change in hatchability represents approximately 1.92 million chicks placed per week and 1.82 million broilers processed, assuming five percent culls and mortality and within the current range of weekly settings. Total chick placements for the U.S. over the five-week period amounted to 967.67 million chicks. Claimed hatchability for the period averaged 79.1 percent for eggs set three weeks earlier. Each 1.0 percent change in hatchability represents approximately 1.92 million chicks placed per week and 1.82 million broilers processed, assuming five percent culls and mortality and within the current range of weekly settings.

Cumulative chick placements for the period January 7th through December 30th 2024 amounted to 9.67 billion chicks. For January 4th through June 14th 2025 chick placements attained 4.61 billion, up one percent from the corresponding week in 2023. placements attained 4.61 billion, up one percent from the corresponding week in 2023.

According to the June 23rd 2025 edition of the USDA Chickens and Eggs, pullet breeder chicks hatched and intended for U.S. placement during May 2025 amounted to 8.17 million, down 0.7 percent (58,000 pullet chicks) from May 2024 and 7.9 percent (699,000 pullet chicks) less than the previous month of April 2025. Broiler breeder hen complement attained 60.30 million on May1st 2025, 2.0 percent (1.23 million hens) less than on May 1st 2024.

Broiler Production May 2025

As documented in the June 19th 2025 USDA Weekly Poultry Slaughter Reports for the processing week ending June 14th 2025, 170.9 million broilers were processed at 6.50 lbs. live. This was 3.6 percent more than the 165.0 million processed during the corresponding week in June 2024. Broilers processed in 2025 to date amounted to 3,963 million, 1.9 percent more than for the corresponding period in 2024.

Ready to cook (RTC) weight for the most recent week in June was 852.2 million lbs. (387,364 metric tons). This was 4.5 percent more than the 815.2 million lbs. during the corresponding week in June 2024. Dressing percentage was a nominal 76.0 percent. For 2025 to date RTC broiler production attained 19.777 million lbs. (8.99 million metric tons). This quantity was 3.4 percent more than for the corresponding period in 2024.

The USDA posted live-weight data for the past week ending June 14th and YTD 2025 included:-

|

Live Weight Range (lbs.)

|

<4.25

|

4.26-6.25

|

6.26-7.25

|

>7.76

|

|

Proportion past week (%)

|

15

|

27

|

26

|

32

|

|

Change from 2020 YTD (%)

|

-7

|

+4

|

-3

|

+10

|

May 2025 Frozen Inventory

According to the June 25th 2025 USDA Cold Storage Report, issued monthly, stocks of broiler products as of May 31st 2025 compared to May 31st 2024 showed differences with respect to the following categories:-

- Total Chicken category attained 754.4 million lbs. (342,905 metric tons) corresponding to approximately one week of production based on recent weekly RTC output. The May 31st 2025 inventory was up 1.0 percent compared to 747,092 million lbs. (389,587 metric tons) on May 31st 2024 and up 0.1 percent from the previous month of April 2025.

- Leg Quarters were down by 2.7 percent to 51.0 million lbs. compared to May 31st 2024 consistent with the data on exports. Inventory was down 6.5 percent from April 2025. Given the trend in inventory of leg quarters it is evident that this category continues to be shipped in varying quantities as the principal (97 percent) chicken export product to a number of nations with The top five importers representing 50.3 percent of the January-April 2025 chicken parts export total of 984,621 metric tons. Mexico was the leading importer with 23.1 percent followed by Cuba (8.9%); Taiwan, (7.0%); Philippines, (6.1%) and Canada, (5.2%)

- The Breasts and Breast Meat category was up 7.0 percent from May 31st 2024 to 223.9 million lbs. indicating a relatively higher domestic consumer demand despite concern over inflation in the cost of protein. May 31st 2025 stock was 0.1 percent lower than on April 30th 2025. The trend through the first four months of 2025 suggests stable but low retail and food service demand for the white meat category. This is despite promotion of chicken sandwiches by QSRs in the face of a higher cost for beef and an increasing pattern of eat-at-home consumption.

- Total inventory of dark meat (drumsticks legs, thighs and thigh quarters but excluding leg quarters) on May 31st 2025 decreased 1.6 percent from May 31st 2024 to 66.1 million lbs. This difference suggests an increase in domestic demand for lower-priced dark meat against the prevailing price of white chicken meat. Prevailing prices for competitive proteins offer an opportunity to increase domestic demand for this category with innovative product development and promotion.

- Wings showed a 10.0 percent increase from May 31st 2024, contributing to a stock of 57.6 million lbs. This category was 0.9 percent lower compared to April 30th 2025. Movement in stock over the past 12 months has demonstrated lower demand for this category due in part from competitive “boneless wings.” Increased consumption traditionally associated with significant sports events including the College Bowl and Super Bowl reduced the volumes of storage in January and February 2025. The progressive increase in unit price during 2024 plateaued in 2025 due to consumer fatigue and competition from competing protein snacks despite continued interest in professional and collegiate football.

- The inventory of Paws and Feet was 23.7 percent higher than on May 31st 2024 to 31.3 million lbs. Stock was was 3.9 percent lower than on April 30th 2025. Prior to the April 2020 Phase-1 Trade Agreement approximately half of the shipments of paws and feet destined for Hong Kong were landed and transshipped to the Mainland, a trend that is re-emerging.

- The Other category comprising 311.2 million lbs. on May 31st 2025 was down 4.0 percent from May 31st 2024 but represented a substantial 41.3 percent of inventory. The high proportion of the Other category suggests further classification or re-allocation by USDA to the designated major categories.

May 2025 Processed Broiler Production

The USDA Poultry Slaughter Report released on June 25th 2025 covered May 2025 comprising 22 working days, one less than May 2024. The following values were documented for the month:-

- A total of 795.8 million broilers were processed in May 2025, down 18.0 million or 2.5 percent from May 2024;

- Total live weight in May 2025 was 5,286 million lbs., down 13.8 million lbs. or 0.3 percent from May 2024;

- Unit live weight in May 2025 was 6.64 lbs., down 0.13lb. (2.0 percent) May 2024.

- RTC in May 2025 attained 3,991 million lbs., down 21.4 million lbs. or 0.5 percent from May 2004.

- WOG yield in May 2025 was 75.5 percent, down from 75.7 percent in May 2024.

- The proportion marketed as chilled in May 2025 comprised 92.9 percent of RTC output compared to 93.7 percent in May 2024.

- Ante-mortem condemnation as a proportion of live weight attained 0.18 percent during May 2025 unchanged from May 2024.

- Post-mortem condemnations as a proportion of processed mass corresponded to 0.43 percent during May 2025 compared to 0.46 percent in May 2024.

Comments

Mexico has recognized the OIE principle of regionalization after intensive negotiations between SENASICA and U.S. counterpart, the USDA-APHIS assisted by USAPEEC. Provided importing nations adhere to OIE guidelines on regionalization, localized outbreaks of avian influenza or possibly Newcastle disease will affect exports only from states or counties with outbreaks in commercial flocks. The response of China, Japan and some other nations is more predictable with bans placed on a nationwide or statewide basis. The response by China to outbreaks is influenced more by self-interest than considerations of scientific fact or international trade obligations. Other importing nations have confined restrictions to counties following the WOAH principle of regionalization. The challenge facing the U.S. as the second largest exporting nation will be to gain acceptance for controlled vaccination against HPAI in specific industry sectors and regions with appropriate surveillance and certification to the satisfaction of importing nations.

Collectively our NAFTA/USMCA neighbors imported broiler products to the value of $471 million over the first four months of 2025 representing 30.8 percent of export value.

|

U.S. Broiler and Turkey Exports, January-April 2025.

|

|

OVERVIEW OVERVIEW

Total exports of bone-in broiler parts and feet during January-April 2025 attained 1,021,432 metric tons, 8.1 percent lower than in January-April 2024 (1,111,867 metric tons). Total value of broiler exports increased by 2.2 percent to $1,531 million ($1,498 million).

Total export volume of turkey products during January-April 2025 attained 57,399 metric tons, 16.0 percent less than in January-April 2024 (68,365 metric tons). Total value of turkey exports increased by 11.9 percent to $219.7 million ($196.3 million).

Unit price for the broiler industry is constrained by the fact that leg quarters comprise over 96 percent of broiler meat exports by volume (excluding feet). Leg quarters represent a relatively low-value undifferentiated commodity lacking in pricing power. Exporters of commodities are subjected to competition from domestic production in importing nations. Generic products such as leg quarters are vulnerable to trade disputes and embargos based on real or contrived disease restrictions. To increase sales volume and value the U.S. industry will have to become more customer-centric offering value-added presentations with attributes required by importers. Whether this will increase margins is questionable given the by-product contribution of leg quarters. A more profitable long-term strategy for the U.S. industry would be to develop products using dark meat to compete with and displace pork and beef in the domestic retail and institutional markets.

HPAI is now accepted to be a panornitic affecting the poultry meat industries of six continents with seasonal and sporadic outbreaks. The incidence rate and location of cases in the U.S. limits eligibility for export depending on restrictions imposed by importing nations

Uncertainty surrounding tariff policy is an added complication potentially impacting export volume in 2025. In the event of reduced exports leg quarters would be diverted to the domestic market resulting in a depression in average value derived from a processed bird.

EXPORT VOLUMES AND PRICES FOR BROILER MEAT

During January-April 2025 the National Chicken Council (NCC), citing USDA-FAS data, documented exports of 984,621 metric tons of chicken parts and other forms (whole and prepared), down 9.0 percent from January-April 2024. Exports were valued at $1,024 million with a weighted average unit value of $1,520 per metric ton.

The NCC breakdown of chicken exports for January-April 2025 by proportion and unit price for each category compared with the corresponding months in 2024 (with the unit price in parentheses) comprised:-

- Chicken parts (excluding feet) 95.2%; Unit value $1,406 per metric ton ($1,277)

- Prepared chicken 4.1%; Unit value $4,155 per metric ton ($4,124)

- Whole chicken 0.7%; Unit value $1,562 per metric ton ($1,630)

- Composite Total 100.0%; Av. value $1,520 per metric ton ($1,363)

The following table prepared from USDA data circulated by the USAPEEC, compares values for poultry meat exports during January-April 2025 compared with the corresponding months of 2024:-

|

PRODUCT

|

Jan.-April. 2024

|

Jan.-April 2025

|

DIFFERENCE

|

|

Broiler Meat & Feet

|

|

|

|

|

Volume (metric tons)

|

1,111,867

|

1,021,432

|

-90,435 (-8.1%)

|

|

Value ($ millions)

|

1,498

|

1,531

|

+36 (+2.4%)

|

|

Unit value ($/m. ton)

|

1,347

|

1,499

|

+152 (+14.3%)

|

|

Turkey Meat

|

|

|

|

|

Volume (metric tons)

|

68,365

|

57,399

|

-10,966 (-16.0%)

|

|

Value ($ millions)

|

196

|

220

|

+24 (+12.2%)

|

|

Unit value ($/m. ton)

|

2,867

|

3,832

|

+965 (+33.7%)

|

COMPARISON OF U.S. CHICKEN AND TURKEY EXPORTS

JANUARY-APRIL 2025 COMPARED TO 2024

BROILER EXPORTS

Total broiler parts, predominantly leg quarters but including feet, exported during January-April 2025 compared with the corresponding months in 2024 declined by 8.1 percent in volume but were up 2.4 percent in value. Unit value was 14.3 percent higher to $1,499 per metric ton.

During 2024 exports attained 3,251,000 metric tons valued at $4,689 million, down 10.5 percent in volume and down 1.1 percent in value compared to 2023. Unit value was up 10.7 percent to $1,442 per metric ton

Broiler imports in 2025 are projected to attain an inconsequential 67,000 metric tons (134 million lbs.) compared to 82,000 metric tons (180,000 million lbs.) in 2024

The top five importers of broiler meat represented 49.8 percent of shipments during January-April 2025. The top ten importers comprised 66.1 percent of the total volume reflecting concentration among the significant importing nations but with a decline in the importance of 8th-ranked China.

Nations gaining in volume compared to the corresponding period in 2024 (with the percentage change indicated) in descending order of volume with ranking indicated by numeral were:-

4. Philippines, (+29%); 5. Canada, (+31%); 10.Ghana, (+50%); 11. Dominican Republic, (+29%) and 14. Haiti, (+5%)

Losses during January-April 2025 offset the gains in exports with declines for:-

1. Mexico, (-3%); 3. Taiwan, (-5%); 6. Guatemala, (-4%); Viet Nam, (-17%); 8. China, (-53%); 9. Angola, (-19%) and UAE, (-4.3)

TURKEY EXPORTS

The volume of turkey meat exported during January-April 2025 declined by 16.0 percent to 57,399 metric tons from January-April 2024 but value was 12.3 percent higher to $220 million compared to January-April 2024. Average unit value was 33.7 percent lower to $2,833 per metric ton.

Imports of turkey products attained 15,000 metric tons (33 million lbs) in 2024 with a similar projection for 2025.

It is important to recognize that exports of chicken and turkey meat products to our USMCA partners amounted to $1,264 million in 2021, $1,647 million during 2022, $1,696 in 2023 and $653 million over the first four-months of 2025. It will be necessary for all three parties to the USMCA to respect the terms of the Agreement in good faith since punitive action against Mexico or Canada on issues unrelated to poultry products will result in reciprocal action by our trading partners to the possible detriment of U.S. agro-industries. This is especially important as Mexico has elected a new Presidenta and a Prime Minister of Canada.

|

The emergence of H5N1strain avian influenza virus with a Eurasian genome in migratory waterfowl in all four Flyways of the U.S. during 2022 was responsible for sporadic outbreaks of avian influenza in backyard flocks and serious commercial losses in egg-producing complexes and turkey flocks but to a lesser extent in broilers. The probability of additional outbreaks of HPAI over succeeding weeks appears likely and will intensify with fall migration of waterfowl Additional outbreaks affecting egg-production and turkey flocks will be a function of shedding by migratory and domestic birds and possibly free-living mammals and extension from dairy herds. Protection of commercial flocks at present relies on the intensity and efficiency of biosecurity including wild-bird laser repellant installations, representing investment in structural improvements and operational procedures. These measures are apparently inadequate to provide absolute protection, suggesting the need for preventive vaccination in high-risk areas for egg-producing, breeder and turkey flocks.

The application of restricted county-wide embargos following the limited and regional cases of HPAI in broilers with restoration of eligibility 28 days after decontamination has supported export volume for the U.S. broiler industry. Exports of turkey products were more constrained with plants processing turkeys in Minnesota, the Dakotas, Wisconsin and Iowa impacted. The challenge will be to gain acceptance for vaccination based on intensive surveillance. It is now accepted that H5N1 HPAI is panornitic in distribution among commercial and migratory birds across six continents. The infection is now seasonally or regionally endemic in many nations with intensive poultry production, suggesting that vaccination will have to be accepted among trading partners as an adjunct to control measures in accordance with WOAH policy.

The live-bird market system supplying metropolitan areas, the presence of numerous backyard flocks, gamefowl and commercial laying hens allowed outside access, potentially in contact with migratory and now some resident bird species, all represent an ongoing danger to the entire U.S. commercial industry. The live-bird segments of U.S. poultry production represent a risk to the export eligibility of the broiler and turkey industries notwithstanding compartmentalization for breeders and regionalization to counties or states for commercial production.

|

|

|

|