On October 5th, the USDA announced an additional $100 million in loan guarantees ostensibly to improve the U.S. supply chain with special reference to the meat and poultry sectors.

On October 5th, the USDA announced an additional $100 million in loan guarantees ostensibly to improve the U.S. supply chain with special reference to the meat and poultry sectors.

In July, the USDA indicated their intention to invest $500 million to expand meat and poultry processing capacity with an additional $150 million to support small and very small facilities that were impacted by COVID restrictions. The USDA has already dispersed $55 million to improve existing small plants and the Department is reviewing 250 applications requesting $100 million.

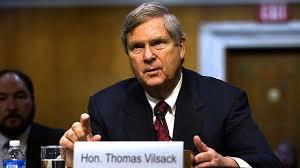

In commenting on the support programs, USDA Secretary Tom Vilsack, stated “As we build back better we must create more better and fairer markets that enhance competition and create economic opportunities across America’s agriculture and food supply chain.” He added, “This initiative is another meaningful step to act on lessons from COVID-19 to build a food system that is fair, competitive, distributed, and resilient where a greater share of the food dollar goes to those growing, harvesting, processing, and preparing our food.”

In commenting on the support programs, USDA Secretary Tom Vilsack, stated “As we build back better we must create more better and fairer markets that enhance competition and create economic opportunities across America’s agriculture and food supply chain.” He added, “This initiative is another meaningful step to act on lessons from COVID-19 to build a food system that is fair, competitive, distributed, and resilient where a greater share of the food dollar goes to those growing, harvesting, processing, and preparing our food.”

The USDA policy of supporting medium and small decentralized plants is supported by the National Cattlemen's Beef Association. Ethan Lane, VP of Governmental Affairs for the Association, stated “The pandemic accentuated a number of vulnerabilities within our supply chains - chiefly the choke point at the meat packing sector which has resulted in unsustainable prices for cattle producers and increased the cost of beef for consumers.”

It is apparent that the events of March through May of 2020, during which COVID restricted most large pork and beef plants to as little as half the regular output, is now being used as an excuse to restructure the meat industry to the advantage of cattle producers and feeders and to reduce the power of the four largest processors.

With respect to the broiler industry, any shortages on shelves during the second quarter of 2020 were due to panic buying and not to any disruption in supply. The U.S. chicken industry has developed into an oligopoly in which the top five producers are responsible for about 65 percent of production. Notwithstanding corporate concentration there are more than 160 plants among 22 states each with an output in excess of 600,000 birds up to 2,500,000 birds per week and operating at a high level of efficiency. As opposed to red meat production the broiler industry is integrated with respect to chick production, grow-out processing, and distribution. This provides security and benefits both to contractors and shareholders and ultimately for consumers.