Editorial

|

GAO Criticizes FDA over Progress in Implementing FSMA

|

|

The Government Accountability Office (GAO) has criticized the U.S. Food and Drug Administration (FDA) for failure to meet the mandates imposed under the 2011 Food Safety Modernization Act (FSMA). Legislation enacted during the Administration of President Obama was intended to create a more proactive FDA and to increase the capacity of the Agency to predict, identify and control outbreaks of foodborne illness. The Government Accountability Office (GAO) has criticized the U.S. Food and Drug Administration (FDA) for failure to meet the mandates imposed under the 2011 Food Safety Modernization Act (FSMA). Legislation enacted during the Administration of President Obama was intended to create a more proactive FDA and to increase the capacity of the Agency to predict, identify and control outbreaks of foodborne illness.

The GAO review identified failure to issue guidance on HACCP for human food, on prevention of intentional adulteration and establishing a national food emergency response laboratory network. The FDA has delayed publishing a manual of acceptable agricultural practices for leafy vegetables and fruits notwithstanding regular seasonal outbreaks of foodborne bacterial disease. The FDA has yet to establish a system to track and trace imported food and domestic production as consumed in the U.S.

Following identification of deficiencies, the GAO issued a series of recommendations. These included:

- Establishing a timeframe for HACCP guidance and preventive controls as required by FSMA.

- The Commissioner of the FDA is required to report on progress implementing guidance to protect against intentional adulteration of food.

- FDA should develop plans and milestones with timelines for product tracing, good agricultural practices for fruits and vegetables

- Expedite the required national emergency response laboratory network.

The FDA has presided over a sequence of potentially avoidable food problems including contamination of infant formula, foodborne disease outbreaks attributed to leafy greens, heavy metal contamination of infant foods. The reorganization of the FDA has consumed the time of administrators and has generated insecurity. This self-inflicted obstacle coupled with injudicious termination of qualified scientists and field personnel has seriously weakened the Agency.

More than a decade ago, EGG-NEWS supported initiatives by professional associations to establish a Food Safety Agency separate from the FDA that could concentrate on aspects of food and nutrition. These critical components of the Nation’s health have traditionally been underserved by the FDA hence the Washington aphorism that the “F” in FDA is pronounced silently!

|

|

Poultry Industry News

|

USDA Cage-Free Production Data for January 2026

|

|

The USDA Cage-Free Report covering January 2026, was released on February 2nd 2026.

The report documented the complement of hens producing under the Certified Organic Program to be 21.0 million (rounded to 0.1 million), up 70,000 hens or 0.3 percent from December 2025. The number of hens classified as cage-free (but excluding Certified Organic) and comprising aviary, barn and other systems of housing apparently increased by 2.2 million hens or 1.9 percent from December 2025 to 121.8 million, attributed to expansion, transition from conventional cages and repopulation of depleted flocks.

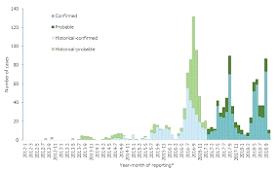

Extensive depopulation was carried out as a result of HPAI through January and February 2025 (31 million), but with lower intensity in March (0.2 million) and April (1.0 million) and a single large complex in Arizona during May (3.8 million). Losses reemerged during late September in a caged-bird complex in Wisconsin (3.1 million hens and 250,000 pullets). Additional depopulations occurred in October, (2.2 million); November, 0.5 million; December, (0.2 million); January (1.5 million) and February (1.4 million).

Average weekly production for Certified Organic eggs in January 2026 was up 1.0 percent percent (rounded) compared to December 2025 with a high average weekly production of 83.9 percent. Average weekly flock production for cage-free flocks other than Certified Organic was up 2.5 percent in January 2026, with a high average hen-month production of 82.6 percent. Seasonally placed flocks in anticipation of periods of peak demand increase the availability of cage-free and organic eggs, reflecting pullet chick placements 20 weeks previously.

There is no adequate explanation for the elevated production rates recorded other than the high proportion of young hens reaching peak placed in anticipation of December demand. It is also assumed that almost all cage free flocks are in the first cycle of production with negligible molting contributing to the high average in hen-week values compared to caged hens.

The categorization of U.S. flocks according to housing system for January was unavailable among the assumed 295 million producing hens. The breakdown will be provided when data is released.

Losses attributed to HPAI in 2025 comprised:-

Caged flocks, 24.8 million representing 8.4 percent of a nominal 290 million producing hens

Cage-free flocks, 17.6 million representing 5.9 percent of the national flock

Organic flocks, negligible, >0.1 percent

|

Average Flock Size

(million hens)

|

Average

January 2025

|

*Average

Q3- 2025

|

Average

Q2- 2025

|

Average

Q1 –

2025

|

Average

Q4 –

2024

|

Average

Q3-

2024

|

|

Certified Organic

|

21.0

|

20.0

|

20.0

|

20.4

|

20.5

|

20.0

|

|

Cage-Free Hens

|

121.8

|

115.6

|

108.4

|

103.4

|

104.5

|

103.9

|

|

Total Non-Caged

|

142.8

|

135.6

|

128.4

|

123.8

|

125.0

|

123.9

|

*October and November data was not released to compile Q4 average

|

Average Weekly Production (cases of 360 eggs)

|

December

2025

|

January

2026

|

|

Certified Organic @ 83.3% hen/day

|

338,683

|

341,966 +1.0%

|

|

Cage-Free @ 82.1% hen/day

|

1,908,273

|

1,955,847 +2.5%

|

|

All Non-Caged @ 82.3% hen/day

|

2,246,956

|

2,297,813 +2.3%

|

On January 2nd 2026 USDA recorded the following National inventory levels expressed in 30-dozen cases (rounded) with the change from December 2025 as a percentage of the total quantity of eggs:-

Commodity shell eggs of all sizes. 1,395,000. (-3.0%)

Commodity breaking stock. 360,800. (-0.4%)

Specialty eggs. 32,400. (+4.9%)

Certified organic eggs. 81,100. (-4.5%)

Cage-Free eggs 438,600. (-1.1%) equivalent to 1.6 days production

|

Average Nest Run Contract Price Cage-Free

White and Brown combined for January 2026

|

$1.73/doz.* (unchanged from May 2025)

|

|

January 2025 Range:

|

$1.55 to $2.10/doz. (unchanged from May 2025)

|

|

FOB Negotiated January price, grade-ready quality, loose nest-run. Price range $0.34 to $1.10 per dozen

|

Average January 2026 Value of $0.63/doz. ($1.10/doz. December 2025)

|

*Essentially a meaningless value

|

Average January 2026 advertisedpromotional National Retail Price C-F, Large Brown

|

$3.45/doz. Jan. 2025 (5 regions)

(Was $3.43/doz. In December 2025)

|

|

USDA Based on 5 ‘Lower 48’ Regions, 937 stores

SW, NW, NE, MW & SC.

|

Range $1.99/doz. (NW) to $4.08/doz. (MW)

|

Negotiated nest-run grade-ready cage-free price for January 2026 averaged $0.43 per dozen, down $0.45 per dozen (-51.7 percent) from $0.88 per dozen in December 2025, reflecting a disturbance in balance between demand and supply.

The January 2026 advertised U.S. featured retail price for Large White cage-free eggs over 1,429 ‘Lower 48’ stores in five regions (NW, NE, SW, MW and SC.) was $2.54 per dozen. This compares with 1,657 stores featuring cage-free Large White in December and reflects fewer promotions as the year has progressed, consistent with lower demand and increased production. The January 2026 advertised U.S. featured retail price for Large Brown cage-free eggs over 957 stores in five regions was $3.45 per dozen with a range of $1.99 per dozen in the NW region to $4.08 per dozen in the MW region. The average promotional shelf price was only 2 cents per dozen above December 2025 for this category

The recorded average gradeable nest run price of $0.43 per dozen for brown and white cage-free combined plus a provision of $0.60 cents per dozen for packaging, packing and transport, resulted in a theoretical price of $1.03 per dozen delivered to CDs. The average advertised promotional retail prices of $3.45 per dozen for Brown and $1.46 per dozen for white represented retail margins of 235 percent for featured Brown and 146 percent for White respectively. Fewer promotions were offered for Brown compared to White-shelled cage-free by stores reflecting the balance between supply and demand for the two broad categories. Margins are presumed higher for non-featured eggs including pastured and other specialty eggs at shelf prices attaining in excess of $8.00 per dozen in high-end supermarket chains. Retailers are maximizing margins especially on Certified Organic, free-range and pastured categories restricting the volumes of sales, of all categories ultimately disadvantageous to producers and consumers.

|

REVIEW OF JANUARY 2025 EGG PRODUCTION COSTS.

|

|

This update of U.S egg-production costs and available prices is provided for the information of producers and stakeholders. Statistical data was unavailable for October and November due to the Federal shutdown. Most January figures are now available and included in this edition.

JANUARY HIGHLIGHTS

- January 2025 USDA ex-farm blended USDA nest-run, benchmark price for conventional eggs from caged hens was 52 cents per dozen, down 70 cents per dozen or 57.3 percent from the December 2025 value of 122 cents per dozen. The corresponding January2024 and 2025 values were respectively $1.72 and $5.82 cents per dozen. For annual comparison, average monthly USDA benchmark price over 2023 was 146 cents per dozen compared to 247 cents per dozen covering 2024. Stock levels and prices prior to the onset of flock depletions due to HPAI indicated a relative seasonal balance between supply and demand. Future nest-run and wholesale prices will be largely dependent on consumer demand for shell eggs and products, as determined by the economy, supply as influenced by flock placements, incidence of HPAI, net exports and the rate of replacement of depopulated pullets and hens and planned depletion. Other considerations include diversion to shell sales from the egg-breaking sector in an interconnected industry.

- Imports of shell eggs continued during the first three quarters of 2025 but with the cumulative negative trade balance attaining 19.9 million dozen shell-equivalents through October. During November the positive trade balance in shell-eggs amounted to 0.3 million dozen. For 2025 through November, U.S. liquid and dried products combined achieved a positive trade balance of 26.3 million case-equivalents with November rising to 10.5 million dozen shell-egg equivalents attributed to shipment of dried egg products mainly to the EU.

- January 2025 USDA ex-farm negotiated USDA nest-run, benchmark price for all categories of cage-free eggs was 63 cents per dozen. The December 2025 value was 110 cents per dozen. The corresponding January 2024 and 2025 values were respectively 380 and 809 cents per dozen.

- Fluctuation in wholesale price is attributed in part to the amplification of upward and downward swings associated with the commercial benchmark price-discovery system in use. An important factor influencing pricing is the proportion of shell eggs supplied under cost-plus contracts. A high proportion of available eggs in this category accentuates the upward and downward price trajectory of uncommitted eggs as determined by the price discovery system. Extreme fluctuation is exemplified by high prices prevailing during the 1st quarter of 2025 and low values during December 2025 and 2026 to date. The magnitude of price fluctuation is inconsistent with relatively small changes in production as flocks are replaced or changes in demand.

- The response to highly pathogenic avian influenza as distorted by the price discovery system was the major driver of prices in 2024 and through 2025 due to the high seasonal incidence rates. Approximately 40 million hens and at least 2.0 million pullets were depleted in 2024 with close to an additional 45 million birds, (hens and pullets) in both large complexes and contract farms through 2025. The Fall 2025 losses involved complexes of 3.1 million hens in late September and 2.0 million in early October. During November 570,000 hens producing table eggs were depopulated on 22 farms in close geographic proximity with flock losses averaging 24,000 per event. This suggested the vulnerability of contract producers of cage free eggs with common risk factors including feed supply and egg collection. This situation is a departure from losses involving a few very large complexes evident in the wave of cases during early fall months. This said in January 2.8 million hens among a few large farms occurred followed by the depopulation of 2.2 million hens in Lancaster County, PA in early February.

- January 2025 USDA average nest-run production cost for conventional eggs from caged flocks over four regions (excluding SW and West), applying updated inputs was 75.5 cents per dozen, up 0.7 cents from December 2025 at 75.5 cents per dozen as influenced by feed cost. The December average nest run production cost for other than caged and certified organic hens was estimated by the EIC to be 96.0 cents per dozen up 0.9 cents per dozen from December. Approximately 60 cents per dozen should be added to the USDA benchmark nest-run costs to cover processing, packing material and transport to establish a realistic cost value as delivered to warehouses.

- January 2026 USDA benchmark nest-run margin for conventional eggs attained a negative value of 24.2 cents per dozen compared to a positive margin of 116.5 cents per dozen in December 2025. For 2025 the average monthly nest-run production margin attained 172 cents per dozen. Average nest-run monthly margin for 2024 was 170.8 cents per dozen compared to 64.2 cents per dozen in 2023 and 155 cents in 2022.

- January 2026 USDA benchmark nest-run margin for all categories of cage-free eggs was a negative 33.0 cents per dozen compared to a positive margin of 14.9 cents per dozen in December 2025. For 2025 the average monthly nest-run production margin attained 293 cents per dozen. Average nest-run monthly margin over 2024 was 440 cents per dozen compared with 100 cents per dozen in 2023, a year with a relatively low incidence rate of HPAI compared to the preceding and following years.

- The December 2025 national flock (over 30,000 hens per farm) was stated by the USDA to be up by 3.7 million hens (rounded, and a probable undercount) to 293.8 million compared to 290.1 in December. There were approximately 326 million hens before the advent of the H5N1 epornitic in 2022. Approximately 3.5 million hens returned to production from molt during the month together with projected maturation of 26 million pullets, with the total offset by depletion of an unknown number of spent hens. On February 4th USDA estimated the total U.S table-egg production flock at 302.0 million with 296.2 million hens actually in production.

- December 2025 pullet chick hatch of 26.3 million was up 0.3 million, (0.3 percent) from November, inconsistent with an increased industry need to replace depopulated flocks.

- November export data is reviewed in a companion article in this edition. In November 2025 exports of shell-eggs and products combined were up 6.2 percent from October 2025 to 487,800 case equivalents representing the theoretical production of 7.2 million hens. Shell egg exports were down 53.1 percent from October totaling 76,000 cases. Exports were dominated by Canada (45 percent of volume) and the “Rest of Americas” including the Caribbean (46 percent). With respect to 411,000 case-equivalents of egg products, up 38.0 percent from the prior month, importers comprised the E.U (61 percent of volume), Canada (2 percent), “Rest of Americas and the EU (7 percent), Japan, (14 percent), Mexico, (4 percent) collectively representing 90 percent of shipments. Volumes exported are based on the needs of importers, competing suppliers, availability in the U.S. and FOB prices offered.

- For 2025 through November the positive trade balance in all shell and derived egg products attained 6.8 million dozen shell equivalents.

|

TABLES SHOWING KEY PARAMETERS FOR JANUARY 2026.

Summary tables for the latest USDA January 2026 costs and unit prices were made available by the EIC on February 10th 2025. Data is arranged, summarized, tabulated and compared with values from the previous January 16th 2025 release reflecting December 2025 costs and production data, as revised and applicable. Monthly comparisons of production data and costs are based on revised USDA and EIC releases.

VOLUMES OF PRODUCTION REFLECTING THE ENTIRE INDUSTRY

|

PARAMETER

|

JANUARY 2026

|

DECEMBER 2025

|

|

Table-strain eggs in incubators

|

53.1 million (Jan.)

|

52.7 million (Dec.)

|

|

Pullet chicks hatched

|

26.3 million (Dec.)

|

26.0 million (Nov.)

|

|

Pullets to be housed 5 months after hatch

|

23.7 million (May ‘26)

|

23.5 million (Apr. ’26)

|

|

EIC December 1st 2026 U.S. total flock projection

|

324.0 million (Feb.)

|

316.0 million (Jan. ‘26)

|

|

National Flock in farms over 30,000

|

293.8 million (Dec.)

|

291.2 million (Nov.)

|

|

National egg-producing flock

|

307.0 million (Dec.)

|

304.0 million (Nov.)

|

|

Cage-free flock excluding organic

Cage-free organic flock

|

121.8 million (Jan.)

21.0 million (Jan.)

|

120.1 million (Dec.)

20.3 million (Dec.)

|

|

Proportion of flocks post-molt

|

10.9% (Dec.)

|

10.7% (Nov.)

|

|

Total of hens in National flock, 1st cycle (estimate)

|

271.5 million (Dec.)

|

267.3 million (Nov.)

|

|

|

Total U.S. Eggs produced (billion)

|

7.82 December 2025

|

7.49 November 2025

|

|

Total Cage-Free hens in production

Proportion of organic population

|

142.8 million (Jan.)

14.2% Organic

|

140.4 million (Dec.)

14.9% Organic

|

|

“Top-9” States hen population (USDA)1

|

177.3 million (Jan.)

|

188.4 million (Nov.)

|

*Source USDA/EIC Note 1. Texas excluded to maintain confidentiality

PROPORTION OF U.S. TOTAL HENS BY STATE, 2025

Based on a nominal denominator of 295 million hens in flocks over 30,000 covering 95 percent of the U.S complement.

USDA has amended inclusion of specific states in regions and eliminated Texas data to protect confidentiality relating to sizes of Company flocks

|

STATE

|

December1

2025

|

November

2025

|

|

Iowa

|

15.2%

|

14.5 %

|

|

Indiana

|

12.0%

|

11.8 %

|

|

Ohio

|

12.9%

|

12.3 %

|

|

Pennsylvania

|

7.8%

|

7.6 %

|

|

Texas (estimate)

|

5.0% ?

|

4.8 %?

|

|

CA MO UT CO2

|

9.6

|

10.1 %

|

- Values rounded to 0.1%

- MO, 4.7%; CA , 2.2%; CO, 2.2%; CO, 1%.

Rate of Lay, weighted hen-month (USDA) 82.2% December 2025. 81.8 % November 2025

*Revised USDA

|

Actual per capita

|

Egg consumption 2020

|

285.6 (down 7.8 eggs from 2019)

|

|

Actual per capita

|

Egg consumption 2021

|

282.5 (down 3.1 eggs from 2020)

|

|

Actual per capita

|

Egg consumption 2022

|

280.5 (down 2.0 eggs from 2021 due to HPAI)

|

|

Actual per capita

|

Egg consumption 2023

|

278.0 (down 2.5 eggs from 2022)

|

|

Actual per capita

Revised per capita

Projection per capita

|

Egg consumption 2024

Egg consumption 2025

Egg consumption 2026

|

270.6 (down 7.2 eggs from 2023) attributed to HPAI losses*

259.2 (down 11.4 eggs from 2024) forecast adjusted for HPAI losses , was 261.1 last month but this was aspirational

273.7 (up 14.5 eggs from 2025 assuming restoration of flocks and without HPAI losses)

|

*Revised, using data from USDA Livestock, Dairy and Poultry Outlook January 16th 2026 taking into account demand from the food service sector and presumably including the effect of HPAI depopulation and net importation.

EGG INVENTORIES AT BEGINNING OF JANUARY 2026:

|

Shell Eggs

|

1.95 million cases in January 2026 up 9.0 percent from December 2025

|

|

Frozen Egg

Products

|

588,278 case equivalents, up 13.1 percent from December 2025

|

|

Dried Egg

Products

|

Not disclosed since March 2020 following market disruption due

To COVID. Moderate levels of inventory are assumed.

|

EGGS BROKEN UNDER FSIS INSPECTION (MILLION CASES) December 2025, 6.50 November 2025, 6.61

|

Cumulative eggs broken under FSIS inspection 2024 (million cases)

|

77.2

|

JAN. TO DEC.

|

|

Cumulative 2024: number of cases produced (million)

|

257.9

|

JAN. TO DEC.

|

|

Cumulative 2024: proportion of total eggs broken

|

29.9%

|

(30.8% 2022)

|

| |

|

|

|

Cumulative eggs broken under FSIS inspection 2025 (million cases)

|

79.4

|

JAN.-DEC.

|

|

Cumulative 2025: number of cases produced (million)

|

245.5

|

JAN.-DEC.

|

|

Cumulative 2025: proportion of total eggs broken

|

32.3%

|

JAN.-DEC.

|

EXPORTS NOVEMBER 2025: (Expressed as shell-equivalent cases of 360 eggs).

|

Parameter

|

Quantity Exported

|

|

Exports:

|

October 2025. November 2025

|

|

Shell Eggs (thousand cases)

|

162. 76

|

|

Products (thousand case-equivalents)

|

297. 411

|

|

TOTAL (thousand case equivalents)*

|

459. 487

|

*Representing 2.0 percent of National production in November 2025 comprising 16% shell, 84% products.

COSTS AND UNIT REVENUE VALUES1 FOR CONVENTIONAL EGGS FROM CAGED HENS

|

Parameter

|

JANUARY 2026

|

DECEMBER 2025

|

|

4-Region Cost of Production ex farm (1st Cycle)1

|

76.2 c/doz

|

75.5 c/doz

|

|

Low

|

74.0c/doz (MW)

|

73.4 c/doz (MW)

|

|

High

|

78.7 c/doz (NE)

|

77.9c/doz (NE)

|

Notes: 1. Excludes SW and West representing an important deficiency

Components of Production cost per dozen:-

| |

JANUARY 2026

|

DECEMBER 2025

|

|

Feed

|

34.5 c/doz

|

34.9c/doz

|

|

Pullet depreciation

|

12.2 c/doz

|

11.9c/doz

|

|

Labor (estimate),

|

|

|

|

Housing (estimate),

|

29.5c/doz

|

28.7c/doz

|

|

Miscellaneous and other (adjusted Jan. 2026)

|

|

|

Ex Farm Margin (rounded to nearest cent) according to USDA values reflecting January 2026:-

52.0 cents per dozen1- 76.2 cents per dozen = -24.2 cents per dozen (December 2025 comparison: 122.0 cents per dozen – 75.5 cents per dozen = 46.5 cents per dozen.

Note 1: USDA Blended nest-run egg price

| |

|

JANUARY 2026

|

DECEMBER 2025

|

|

USDA

|

Ex-farm Price (Large, White)

|

52.0 c/doz (Jan.)

|

122.0 c/doz (Dec.)

|

| |

Warehouse/Dist. Center

|

96.0 c/doz (Jan.)

|

174.0 c/doz (Dec.)

|

| |

Store delivered (estimate)

|

101.0 c/doz (Jan.)

|

179.0 c/doz (Dec.)

|

| |

Dept. Commerce Retail1 National

|

271.0 c/doz (Dec.)

|

286.0 c/doz (Nov.)

|

| |

Dept. Commerce Retail1 Midwest

|

N/A. (Dec.)

|

N/A (Nov.)

|

- Unrealistic USDA values based on advertised promotional prices with few participating stores, non-representative of shelf prices!

| |

JANUARY 2026

|

DECEMBER 2025

|

|

U.S. Av Feed Cost per ton

|

$222.97

|

$225.36

|

|

Low Cost – Midwest

|

$201.36

|

$203.73

|

|

High Cost – West

|

$260.42

|

$263.73

|

|

Differential

Corn/ton 5 regions

Soybean meal/ton 5 regions

|

$ 59.06

$172.26

$319.14

|

$ 60.00

$174.42

$326.65

|

|

Pullet Cost 19 Weeks

|

$4.74 JANUARY 2026

|

$4.65 DECEMBER 2025

|

|

Pullet Cost 16 Weeks

|

$4.18 JANUARY 2026

|

$4.10 DECEMBER 2025

|

AVERAGE COSTS AND UNIT REVENUE FOR EGGS FROM CAGE-FREE HENS

|

Parameter

|

JANUARY 2026

|

DECEMBER 2025

|

|

5-Region Cost of Production ex farm (1st Cycle)

|

96.0 c/doz

|

95.1 c/doz

|

|

Low

|

91.7c/doz (MW)

|

90.7 c/doz (MW)

|

|

High

|

103.5 c/doz (West)

|

102.8 c/doz (West)

|

Components of Production cost for cage-free eggs, per dozen:-

| |

JANUARY 2026

|

DECEMBER 2025

|

|

Feed (non-organic)

|

39.9 c/doz

|

40.2 c/doz

|

|

Pullet depreciation

|

16.1 c/doz

|

15.8 c/doz

|

|

Labor (estimate) plus

|

|

|

|

Housing (estimate) plus

|

40.0c/doz

|

39.1 c/doz

|

|

Miscellaneous and other

|

|

|

Ex Farm Margin (rounded to cent) according to USDA values reflecting negotiated price for January 2026:-

Cage-Free brown 63.0 cents per dozen1- 96.0 cents per dozen =-33.0 cents per dozen

December 2025:-110.0 cents per dozen1- 95.1 cents per dozen = +14.9 cents per dozen

| |

|

JANUARY 2026

|

DECEMBER 2025

|

|

USDA

|

USDA Average Ex-farm Price1

Gradable nest run2

|

173 c/doz (Jan.)

63 c/doz. (Jan.)

|

173 c/doz (Dec .)

110 c/doz. (Dec.)

|

| |

Warehouse/Dist. Center3

|

c/doz (Jan.)

|

c/doz (Dec.)

|

| |

Store delivered (estimate)

|

c/doz (Jan.)

|

c/doz (Dec.)

|

| |

Dept. Com. Retail4 C-F White

Dept. Com. Retail4 C-F Brown

|

254 c/doz (Jan.)

345 c/doz (Jan.)

|

263 c/doz (Dec.)

343 c/doz (Dec.)

|

| |

Dept. Com. Retail3 Organic

Dept. Com. Retail3 Pasture

|

503 c/doz (Jan.)

644 c/doz (Jan.)

|

573 c/doz (Dec.)

664 c/doz. (Dec.)

|

Contract price, nest-run loose. Range 155 to 210 c/doz. Negligible change since July 2024 and totally unrealistic.- Negotiated price, loose. Range $0.34 to $1.10 per dozen

- Estimate based on prevailing costs

- Unrealistic USDA values based on promotional prices with few participating stores and non-representative of shelf prices

|

Cage-Free* Pullet Cost 19 Weeks

|

$5.76 NOVEMBER 2025

|

$5.60 DECEMBER 2025

|

|

Cage-Free* Pullet Cost 16 Weeks

|

$5.04 NOVEMBER 2025

|

$4.94 DECEMBER 2025

|

* Conventional (non-organic) feed

Feed prices used are the average national and regional values for caged flocks. Excludes organic feeds with prices substantially higher than conventional.

|

Preamble

|

|

Barbara and I supported by our Sponsor VAL-CO Industries wish our subscribers and friends in the industry a productive and enjoyable IPPE and a safe return. Regrettably we will not be with you at the 2026 event but hope to meet with you at PEAK in April

Simon

|

VAL-CO Innovations at the IPPE

|

|

WEEDEN SPRINKLER SYSTEM

VAL-CO, recently appointed as international distributors of the Weeden sprinkler will display the system on their Booth B10021. Weeden Sprinkler Systems was established in 1995 and has remained in the founder family after acquisition by Kevin Weeden in 2003.

The system is design to supplement conventional pad cooling during periods of high temperature. Sprinklers are installed at approximately 24’ intervals down the length of the house located in two rows 12’ from the side walls. The system is operated in conjunction with evaporative cooling pads that should be activated only when ambient temperature exceeds 88 Fº. The Weeden sprinkler system permits delaying the operation of cool cells reducing humidity in the house and saving water.

The Weeden control panel incorporates two separate time clocks to activate the sprinklers that stimulate movement of the flock and contribute to cooling of birds. Specific zones can be selected in the house to operate independently. This permits operation of sprinklers at a higher intensity at the exhaust end of the house where temperatures may be higher than at the air inlet end when houses are operated in tunnel mode. The controller can be pre-programed for flock age and temperature to conform to the biomass in the house and to respond to weather conditions.

Activating the sprinkler system promotes growth by stimulating birds to rise from recumbency on litter and to seek food and water. Droplets on the head and back plumage evaporate subject to adequate air movement, producing an external cooling effect.

Sprinkler intervals commence for a ten second duration at 30-minute intervals and can increase up to a 20-second cycle every seven minutes during extreme heat. At maximum duration of 20 seconds, each sprinkler operated at line pressure above 30psi releases 10 ounces of water covering an area of 500 sq. ft. Again, depending on the critical airflow, the system can release five gallons of water within a 25,000 sq. ft. house per 20 second cycle. Maintaining a high rate of evaporation limits litter moisture since droplets are converted to vapor that is exhausted from the house.

Coarse droplets from the Weeden sprinkler system are approximately 1mm in diameter and approximately 10 times the size of mist particles released by high-pressure foggers. Sprinklers are equipped with check valves to prevent dripping, and all sprinklers start and stop at the same time.

The Weeden sprinkler system has been evaluated by the University of Arkansas, Division of Agriculture Research and Extension. Studies have shown that relative humidity in houses is lower using the Weeden system compared to houses fitted with conventional pads that tend to be overused. This results in reduced water usage and drier litter. In a typical broiler house located in Mississippi, operation of the Weeden system resulted in a 64 percent reduction in water used to an average of approximately 9,000 gallons per cycle with a 5 percent reduction in average in-house humidity at the expense of a 3F increase in average summer temperature within the house. Stimulating feed, and water intake contributed to enhanced growth providing the grower with 0.16 cents per pound higher settlement value over two successive summer cycles compared to controls without Weeden Sprinklers.

The Weeden sprinkler system operated in accordance with recommended parameters in conjunction with evaporative cooling pads could enhance growth and return subject to maintaining appropriate longitudinal air movement through the house.

COMFORT NEST™

With an emphasis on breeder hatchability, increasing the proportion of nest-laid eggs and achieving clean shells are important objectives contributing to hatch and hence profitability. VAL-CO will demonstrate the Comfort Nest™ installation at the IPPE. The double-wide nests with a 19” wide entry are more attractive to hens than conventional single-hole nests, reducing floor eggs.

Eggs roll out gently onto a 5” wide polyethylene side-mounted belt with holes allowing ventilation and contributing to unsoiled eggshells. An optional 5" cloth belt is available depending on customers' preference. Nests are equipped with closers to allowing hens to exit nests but deterring re-entry. This reduces the occurrence of broody hens or low-ranked birds hiding in nests and soiling of pads by hens roosting in nests at night.

VAL-CO Comfort Nests are constructed with heavily galvanized steel including partitions. The system can be installed in houses up to 600’ in length.

The automated Comfort Nest™ system can be supplied with a VAL-CO egg collection table constructed from steel for optimal durability.

MACH 57™ SERIES FANS

Responding to the need for greater efficiency in ventilation, VAL-CO has introduced the MACH 57™ series designed for exterior mounting. Within the MACH 57™ range, VAL-CO offers the 50 Hz models with either 1.5 or 2.0 HP rated at 32,000 cfm with 0.05" swp declining to 25,000 cfm at 0.20" swp. The 60 Hz models range in displacement from 31,200 cfm to 34,100 cfm at 0.05" swp.

All fans are designed for optimal air speed and displacement and are fabricated from galvanized coated steel and constructed with corrosive resistant materials. The MACH 57™ range uses many common components in common with 54" VAL-CO fans to reduce inventory of spare parts.

The MACH 57™ fan is available with a compatible exterior mount with a cone and dampers. The unit is constructed of polypropylene and fiberglass for a long service life. The interior of the mount is coated black to reduce entry of light.

The MACH 57™ series fans can be supplied to operate with voltages ranging from 208 to 230v, 190 to 380v or 208 to 230/460v supply.

SRP® AUX INFRARED BROODERS

VAL-CO will feature SRP® infrared brooders designed for optimal chick comfort to promote growth. The AUX range offered in the U.S. comprises 20 ft. units rated at either 80,000 or 100,00 BTU/hr. SRP® series infrared tube heaters eliminate hot spots over litter and can be ordered with SMART Optizone controllers that allow decentralized zoning, remote monitoring, allowing changes in set points and alerts.

The 20 ft. long radiant tube heaters are endorsed by agricultural engineers affiliated with the UGA Extension Poultry Science Service based on their field evaluation based on even distribution of heat promoting regular distribution of chicks. Temperature variations at litter level are less than 10F in houses. Thermal imaging during brooding provided data supporting the litter-level temperatures located adjacent to outside feeder lines and inside drinker lines.

The University of Georgia extension specialists recommend installing two rows of 20 ft. heaters within 6 ft. of the outer feed lines lengthwise in the brooding area. This arrangement distributes heat evenly over the litter area closer to the sidewalls reducing litter moisture and places the tube heaters closest to incoming cold air from the sidewall inlets. This helps to counteract leakage of cold air through fissures in the sidewalls of older houses.

Further field trials are in progress to evaluate advantages from longer infrared radiant brooders with special reference to fuel consumption, evenness of the flock, feed consumption efficiency and settlement values for flocks.

FUZE® V GRILL-LESS FEEDER PANS AVAILABLE WITH ONCE ILLUMINATION

VAL-CO, will promote the combination of their FUZE feed pan LINES in association with ONCE by Signify Optient lighting. Synergy from the two systems will promote flock uniformity with optimal growth and yield. VAL-CO, will promote the combination of their FUZE feed pan LINES in association with ONCE by Signify Optient lighting. Synergy from the two systems will promote flock uniformity with optimal growth and yield.

The FUZE® V Grill-Less feed pan was designed in cooperation with leading growers. Objectives were to reduce chick mortality and to improve feed conversion efficiency. Features of the FUZE® V include:

- Access to feed in pans from day of placement

- An adjustable collar to regulate feed level according to flock age

- The lip of the pan is designed to prevent scratching and wastage

The Optient lighting system from ONCE by Signify is installed above the feed line to attract broilers of all ages in accordance with natural behavior. Field trials show an improvement in feed conversion of up to four points at the time of harvest. Energy consumption is reduced by up to 70 percent compared to conventional LED ceiling lights. Some growers use only the Optient installation after the end of the brooding period.

The modular LED lights are easy to install using a patented twist-and-hook arrangement.

VAL-CO has been appointed as the exclusive U.S. distributor for the Optient lighting system and can supply installations separately for retrofit or as a combined package.

Valli Baby Area Rearing Aviary

It is universally accepted that rearing aviaries should be compatible with housing of the flock after transfer. Manufacturers of alternative housing systems including Valli of Italy have conducted extensive research and development on brooding systems to ensure that flocks achieve maturity at a uniform weight and time so as to optimize peak and subsequent production.

The Valli Baby Area system will be displayed on the VAL-CO booth. The rearing aviary incorporates design features to facilitate management of replacement flocks. Chicks can be monitored after placement in a single tier. The front grills can be adjusted continuously from closure to complete opening to allow flocks to access litter. The external perches are adjustable in height to conform to the growth of the flock. The Valli Baby Area rearing system offers optimal use of floor space with appropriate positioning of the chain feeder and nipple drinker lines.

Valli offers a range of options with regard to the number of tiers and the flexibility inherent in the system allows retrofitting to existing houses sold, installed and serviced by VAL-CO.

|

U.S. Broiler and Turkey Exports, January Through October 2025.

|

|

OVERVIEW OVERVIEW

Total exports of bone-in broiler parts and feet during January-October 2025 attained 2,585,961 metric tons, 4.1 percent lower than in January-October 2024 (2,697,121 metric tons). Total value of broiler exports increased by 0.7 percent to $3,883 million ($3,856 million).

Total export volume of turkey products during January-October 2025 attained 155,960 metric tons, 15.6 percent less than in January-October 2024 (184,727 metric tons). Total value of turkey exports increased by 14.5 percent to $636 million ($555 million).

Average unit price attained by the broiler industry is constrained by the fact that leg quarters comprise over 96 percent of broiler meat exports by volume (excluding feet). Leg quarters represent a relatively low-value undifferentiated commodity lacking in pricing power. Exporters of commodities are subjected to competition from domestic production in importing nations. Generic products such as leg quarters are vulnerable to trade disputes and embargos based on real or contrived disease restrictions. To increase sales volume and value the U.S. industry will have to become more customer-centric offering value-added presentations with attributes required by importers. Whether this will increase margins is questionable given that leg quarters are regarded as a by-product of broiler production. A more profitable long-term strategy for the U.S. industry would be to develop products using dark meat to compete with and displace pork and beef in the domestic retail and institutional markets. Due to a shortage and hence high price for beef presentations this opportunity is now evident.

HPAI is now accepted to be panornitic affecting the poultry meat industries of six continents with seasonal and sporadic outbreaks. The incidence rate and location of cases in the U.S. has limited the eligibility for export from many plants depending on restrictions imposed by importing nations. Incident cases in the U.S. have continued at a low rate in egg-production flocks and in turkeys but a resurgence is anticipated during the first quarter of 2026.

Uncertainty surrounding tariff policy is an added complication potentially impacting export volume in 2026. In the event of reduced exports, leg quarters would be diverted to the domestic market resulting in a depression in average value derived from a processed bird.

To offset an anticipated decline in exports of U.S. agricultural products the USDA will make available $285 million during 2026 for trade promotion including trade reciprocity missions and credit guarantees under the GSM-102 program.

EXPORT VOLUMES AND PRICES FOR BROILER MEAT

The following table prepared from USDA data circulated by the USAPEEC, compares values for poultry meat exports during January-October 2025 compared with the corresponding months during 2024:-

|

PRODUCT

|

Jan.-Oct. 2024

|

Jan.-Oct. 2025

|

DIFFERENCE

|

|

Broiler Meat & Feet

|

|

|

|

|

Volume (metric tons)

|

2,697,121

|

2,585,961

|

-111,160 (-4.1%)

|

|

Value ($ millions)

|

3,856

|

3,883

|

+27 (+0.7%)

|

|

Unit value ($/m. ton)

|

1,430

|

1,502

|

+72 (+5.0%)

|

|

Turkey Meat

|

|

|

|

|

Volume (metric tons)

|

184,727

|

155,960

|

-28,767 (-15.6%)

|

|

Value ($ millions)

|

555

|

636

|

+81 (+14.5%)

|

|

Unit value ($/m. ton)

|

3,005

|

4,078

|

+1.073 (+35.7%)

|

COMPARISON OF U.S. CHICKEN AND TURKEY EXPORTS

JANUARY-OCTOBER 2025 COMPARED TO 2024

BROILER EXPORTS

Total broiler parts, predominantly leg quarters but including feet, exported during January-October 2025 compared with the corresponding months in 2024 declined by 4.1 percent in volume but value was up 0.7 percent. Unit value was 5.0 percent higher to $1,502 per metric ton.

During 2024 exports attained 3,251,000 metric tons valued at $4,689 million, down 10.5 percent in volume and down 1.1 percent in value compared to 2023. Unit value was up 10.7 percent to $1,442 per metric ton

Broiler imports in 2025 are projected to attain an inconsequential 67,000 metric tons (134 million lbs.) compared to 82,000 metric tons (180,000 million lbs.) in 2024

The top five importers of broiler meat represented 51.1 percent of shipments during January-October 2025. The top ten importers comprised 69.3 percent of the total volume reflecting concentration among the significant importing nations.

Eighth-ranked China declined 43.1 percent in volume to 78,306 tons and concurrently by 31.3 percent in value to $242 million over the first ten months of 2025 compared to the corresponding period in 2024. Unit value increased by 20.9 percent to $3,093 per metric ton reflecting the high proportion of feet in consignments

Nations gaining in volume compared to the corresponding period in 2024 (with the percentage change indicated) in descending order of volume with ranking indicated by numeral were:-

2. Taiwan, (+35%); 4. Philippines, (+31%); 5. Canada, (+15%); 10. Haiti, (+27%); 11. Ghana, (+16%); 13, Dominican Rep., (+1%) and 17. Congo-Kinshasa), (+85%)

Losses during January-October 2025 offset the gains in exports with declines for:-

1. Mexico, (-8%); 3. Cuba, (-10%); 6. Guatemala, (-1%); 7. Angola, (-19%);

8. China, (-43%); 9. Viet Nam, (-31); 12. UAE, (-6%); 14. Hong Kong, (-38%)

and 15. Georgia, (-23%).

TURKEY EXPORTS

The volume of turkey meat exported during January-October 2025 declined by 15.6 percent to 155,960 metric tons from January-October 2024 but value was 14.5 percent higher at $636 million. Average unit value was 35.7 percent higher at $4,078 per metric ton.

Imports of turkey products attained 15,000 metric tons (33 million lbs.) in 2024 with a similar projection for 2025.

Mexico imported 124,127 tons during the 10-month period representing 79.6 percent of volume. Value attained $506 million comprising 79.6 percent of value at a unit price of $4,073 per ton. Canada imported 5,065 tons valued at $18 million with a unit price of $3,514 per ton.

It is important to recognize that exports of chicken and turkey meat products to our USMCA partners amounted to $1,264 million in 2021, $1,647 million during 2022, $1,696 in 2023 and $1,732 million over the first ten-months of 2025. It will be necessary for all three parties to the USMCA to respect the terms of the Agreement in good faith since punitive action against Mexico or Canada on issues unrelated to poultry products will result in reciprocal action by our trading partners to the possible detriment of U.S. agriculture. This is especially important as all three nations have recently elected chief executives and administrations.

The emergence of H5N1strain avian influenza virus with a Eurasian genome in migratory waterfowl in all four Flyways of the U.S. during 2022 was responsible for sporadic outbreaks of avian influenza in backyard flocks and serious commercial losses in egg-producing complexes and turkey flocks but to a lesser extent in broilers. The probability of additional outbreaks of HPAI over succeeding weeks appears likely with recorded outbreaks in turkey farms in ND, SD and MN. Consistent with fall migration of waterfowl. Incident cases affecting egg-production and turkey flocks will be a function of shedding by migratory and domestic birds and possibly free-living mammals or even extension from dairy herds. Protection of commercial flocks at present relies on the intensity and efficiency of biosecurity including wild-bird laser repellant installations, representing investment in structural improvements and operational procedures. These measures are apparently inadequate to provide absolute protection, suggesting the need for preventive vaccination in high-risk areas for egg-producing, breeder and turkey flocks.

The application of restricted county-wide embargos following the limited and regional cases of HPAI in broilers with restoration of eligibility 28 days after decontamination has supported export volume for the U.S. broiler industry. Exports of turkey products were more constrained with plants processing turkeys in Minnesota, the Dakotas, Wisconsin and Iowa impacted. The future challenge will be to gain acceptance for limited preventive vaccination of laying hens and turkeys in high-risk areas accompanied by intensive surveillance. It is now accepted that H5N1 HPAI is panornitic in distribution among commercial and migratory birds across six continents. The infection is now seasonally or regionally endemic in many nations with intensive poultry production, suggesting that vaccination will have to be accepted among trading partners as an adjunct to control measures in accordance with WOAH policy.

The live-bird market system supplying metropolitan areas, the presence of numerous backyard flocks, gamefowl and commercial laying hens allowed outside access, potentially in contact with migratory and now some resident bird species, all represent an ongoing danger to the entire U.S. commercial industry. The live-bird segments of U.S. poultry production represent a risk to the export eligibility of the broiler and turkey industries notwithstanding WOAH compartmentalization for breeders and regionalization (zoning) to counties or states for commercial production.

|

Monthly Broiler Production Statistics, December-January.

|

|

Broiler Chick Placements December 2025-January 2026

According to the January 14th 2026 USDA Broiler Hatchery Report, 1,510 million eggs were set over six weeks extending from December 6th 2025 through January 10th 2026 inclusive. This was approximately one percent higher compared to the corresponding period in 2024/5. According to the January 14th 2026 USDA Broiler Hatchery Report, 1,510 million eggs were set over six weeks extending from December 6th 2025 through January 10th 2026 inclusive. This was approximately one percent higher compared to the corresponding period in 2024/5.

Total chick placements for the U.S. over the six-week period amounted to 1,177 million chicks. Claimed hatchability for the period averaged 79.7 percent for eggs set three weeks earlier. Each 1.0 percent change in hatchability represents approximately 1.93 million chicks placed per week and 1.83 million broilers processed, assuming five percent culls and mortality and within the current range of weekly settings.

Cumulative chick placements for the period January 4th through December 27th 2025 amounted to 10.00 billion chicks up approximately one percent from calendar 2024. For the first two hatch weeks of 2026 chick placements attained 0.39 billion, up one percent from the corresponding value in 2025.

According to the December 19th 2025 edition of USDA Chickens and Eggs, pullet breeder chicks hatched and intended for U.S. placement during November 2025 amounted to 8.08 million, down 2.2 percent (0.19 million pullet chicks) from November 2024 and 3.7 percent (288,000 pullet chicks) more than the previous month of October 2025. Broiler breeder hen complement attained 59.82 million in November 2025, 1.6 percent (1.00 million hens) down from December 2024 and 1.7 percent (988,000 hens) higher than October 2025.

Broiler Production 2026

As documented in the January 15th 2026 USDA Weekly Poultry Slaughter Reports for the processing week ending January 10th 2025, 173.6 million broilers were processed at 6.69 lbs. live. This was 12.7 percent more than the 154.1 million processed during the corresponding week in January 2025, constrained by holiday schedule. Broilers processed for the first two weeks in 2026 amounted to 0.32 million, 10.1percent more than for the corresponding period in 2025.

Ready to cook (RTC) weight for the most recent week in January was 881.6 million lbs. (400,727 metric tons). This was 12.6 percent more than the 783.2 million lbs. during the corresponding week in January 2025. Dressing percentage was a nominal 76.0 percent. For 2026 to date RTC broiler production attained 1,603 million lbs. (0,728 million metric tons). This quantity was 8.7 percent more than for the corresponding period in 2024.

The USDA posted live-weight data for the past week ending January 10th and YTD 2026 including:-

|

Live Weight Range (lbs.)

|

<4.25

|

4.26-6.25

|

6.26-7.25

|

>7.76

|

|

Proportion past week (%)

|

16

|

27

|

25

|

32

|

|

Change from 2020 YTD (%)

|

0

|

+2

|

+32

|

+6

|

Inventory and processing data for December 2025 has yet to be released by USDA at the time of compilation of this report

November 2025 Frozen Inventory

According to the December 23rd 2025 USDA Cold Storage Report, the first to be released after the Federal shutdown, stocks of broiler products as of November 30th 2025 compared to November 30th 2024 showed differences with respect to the following categories:-

- Total Chicken category attained 814.9 million lbs. (370.4 thousand metric tons) corresponding to approximately one week of production based on recent weekly RTC output. The November 2025 inventory was up 0.7 percent compared to 809,039 million lbs. (368.8 thousand metric tons) on November 30th 2024 and up 0.4 percent from the previous month of October 2025.

- Leg Quarters were down 16.0 percent to 55.6 million lbs. compared to November 30th 2024 consistent with the data on exports. Inventory was up 2.0 percent from July 31st 2025. Given the trend in inventory of leg quarters it is evident that this category continues to be shipped in varying quantities as the principal (96 percent) chicken export product to a number of nations.

- The Breasts and Breast Meat category was up 2.8 percent from November 30th 2024 to 242.1 million lbs. indicating a relatively lower domestic consumer demand for this category despite concern over inflation in the cost of alternative proteins. The November 30th 2025 stock level was 2.1 percent higher than October 31st 2025. The trend through the first eleven months of 2025 suggests stable but low retail and food service demand for the white meat category. This is despite promotion of chicken sandwiches and wraps by QSRs in the face of a higher cost for beef coupled with an increasing pattern of eat-at-home consumption.

- Total inventory of dark meat (drumsticks legs, thighs and thigh quarters but excluding leg quarters) on November 30th 2025 decreased 3.6 percent from November 30th 2024 to 65.9 million lbs. This difference suggests an increase in domestic demand for lower-priced dark meat against the prevailing price of white chicken meat. Higher prices for competitive proteins offer an opportunity to increase domestic demand for this category with innovative product development and promotion.

- Wings showed a 3.8 percent decrease from November 30th 2024, contributing to a stock of 57.1 million lbs. Inventory of wings was 5.2 percent lower compared to the end of October 2025. Movement in stock over the past 12 months has demonstrated slightly higher demand for this category despite competition from “boneless wings.” Increased consumption traditionally associated with significant sports events including the College and Super Bowls reduced the volumes of storage in January and February 2025. The progressive increase in unit price during 2024 plateaued in 2025 due to consumer fatigue and competition from competing protein snacks despite continued interest in professional and collegiate football.

- The inventory of Paws and Feet was 15.8 percent lower than on November 30th 2024 to 27.6 million lbs. Stock was 3.0 percent higher than on October 31st 2025. Prior to the April 2020 Phase-1 Trade Agreement approximately half of the shipments of paws and feet destined for Hong Kong were landed and transshipped to the Mainland, a trend that is re-emerging.

- The Other category comprising 345.0 million lbs. on November 30th 2025 was up 4.1 percent from November 30th 2024 but represented a substantial 42.3 percent of inventory. The high proportion of the Other category suggests further classification or re-allocation by USDA to the designated major categories.

November 2025 Processed Broiler Production

The delayed monthly USDA Poultry Slaughter Report was released on December 5th 2025 covering October 2025, with the NASS having skipped September due to the Federal shutdown in October. The month comprised 23 working days, the same as November 2024. The following values were documented for the month of October:-

- A total of 870.1 million broilers were processed in October 2025, up 8.4 million or 1.0 percent from August 2024;

- Total live weight in August 2025 was 5,304 million lbs., down 38.7 million lbs. or 0.7 percent from October 2024;

- Unit live weight in October 2025 was 6.72 lbs., up 0.02lb. (0.3 percent) from October 2024.

- RTC in October 2025 attained 4,426 million lbs., up 55.9 million lbs. or 1.3 percent from October 2004.

- WOG yield in October 2025 was 75.7 percent, down from 75.8 percent in October 2024.

- The proportion marketed as chilled in October 2025 comprised 92.9 percent of RTC output compared to 93.3 percent in October 2024.

- Ante-mortem condemnation as a proportion of live weight attained 0.19 percent during October 2025 down from 0.17 percent in October 2024.

- Post-mortem condemnations as a proportion of processed mass corresponded to 0.41 percent during October 2025 compared to 0.44 percent in October 2024.

Comments

Mexico has recognized the OIE principle of regionalization after intensive negotiations between SENASICA and the U.S. counterpart, USDA-APHIS assisted by USAPEEC. Provided importing nations adhere to OIE guidelines on regionalization, localized outbreaks of avian influenza or possibly Newcastle disease will affect exports only from states or counties with outbreaks in commercial flocks. The response of China, Japan and some other nations is less predictable with bans placed on a nationwide or statewide basis. The response by China to outbreaks is influenced more by self-interest than considerations of scientific fact or international trade obligations. Other importing nations have confined restrictions to counties following the WOAH principle of regionalization. The challenge facing the U.S. as the second largest exporting nation after Brazil, will be to gain acceptance for controlled vaccination against HPAI in specific industry sectors and regions with appropriate surveillance and certification to the satisfaction of importing nations.

|

USDA-WASDE REPORT #667. January 12th 2026

|

|

OVERVIEW OVERVIEW

Understandably the January 12th edition of the World Agriculture Supply and Demand Estimates (WASDE) #667 projecting the 2026 season was extensively revised with respect to corn and soybeans from the previous post-shutdown December 9th edition reflecting the 2025 crop. Crop size and ending stocks were derived from previous harvest data, projections for domestic use and the effect of tariff policy and competition that influence export volumes

The January WASDE report projected that the 2026 corn crop will be harvested from an expanded 91.3 million acres, (90.0 million acres in 2025). The soybean crop will be harvested from an almost unchanged 80.4 million acres, (80.3 million acres in 2025).

The January WASDE yield value for the 2026 corn crop was raised 0.5 bushels to 186.5 bushels per acre. By comparison corn yield was 183.1 bushels per acre in 2024. Soybean yield was held at 53.0 bushels per acre, unchanged from 2025 reflecting previous harvests. By comparison soybean yield was 51.7 bushels per acre for the 2024 crop.

The January WASDE projection for the 2026 ending stock of corn was raised by 9.8 percent from December to 2,227 million bushels. The January USDA projection for the 2026 ending stock of soybeans was raised 20.7 percent from December to 350 million bushels consistent with domestic use and export projections.

The January WASDE raised the projected corn price for the 2026-2027 market year by 10 cents to an average of 410 cents per bushel. The projected average season price for soybeans was lowered by 30 cents to 1,020 cents per bushel. The price of soybean meal was lowered from the December WASDE by $5 to $295 per ton.

USDA commodity prices suggest stable feed costs for livestock and poultry producers given projections for yields, domestic use and exports. In some areas return from corn will be below break-even given relative yields, production costs and depressed per bushel prices. The USDA has announced an allocation of $12 billion to row-crop farmers to compensate for prolonged low commodity prices resulting from reduced exports occasioned by tariffs imposed by the U.S.

Projections for world output included in the January 2026 WASDE report, reflect the most recent estimates for the production and export of commodities especially in the Southern Hemisphere with an emphasis on volumes and prices offered by Argentine and Brazil. Economists also consider the impact of weather patterns arising from Southern Oscillation events especially on Brazil and Argentina.

It is accepted that USDA projections for exports will be influenced by the fluid situation relating to tariffs. Estimates of exports are also based on the perceived intentions and needs of China. This Nation sharply curtailed purchases of commodities and especially U.S. soybeans since the 2024-2025 market year and the current year to date.

CORN

Production parameters for corn were updated from the December WASDE, reflecting the predicted yield, and updated projections for domestic use and trade. The January WASDE Report projected a 2026 crop of 17,021 million bushels, compared to 16,752 million bushels for the previous 2025 record harvest. The “Feed and Residual” category was raised 100 million bushels. (1.6 percent) for 2026 to 6,200 million bushels. The Food and Seed category was projected at 1,370 million bushels down 10 million bushels. The Ethanol and Byproducts Category was retained at 5,600 million bushels consistent with estimated demand for E-10 and higher blends for driving needs during winter months. Projected corn exports were held at 3,300 million bushels, based on recent orders and shipments. The anticipated ending stock of corn will be up 9.8 percent to 2,227 million bushels or 12 percent of projected availability. Production parameters for corn were updated from the December WASDE, reflecting the predicted yield, and updated projections for domestic use and trade. The January WASDE Report projected a 2026 crop of 17,021 million bushels, compared to 16,752 million bushels for the previous 2025 record harvest. The “Feed and Residual” category was raised 100 million bushels. (1.6 percent) for 2026 to 6,200 million bushels. The Food and Seed category was projected at 1,370 million bushels down 10 million bushels. The Ethanol and Byproducts Category was retained at 5,600 million bushels consistent with estimated demand for E-10 and higher blends for driving needs during winter months. Projected corn exports were held at 3,300 million bushels, based on recent orders and shipments. The anticipated ending stock of corn will be up 9.8 percent to 2,227 million bushels or 12 percent of projected availability.

The forecast USDA average season farm price for corn in the January WASDE report was 410 cents per bushel. At close of trading after the noon January 12th release of the WASDE, the CME spot price for corn was 421 cents per bushel, 2.7 percent above the USDA projection and 6.0 percent below the December 9th CME price.

JANUARY 2026 WASDE #667 Summary for the 2025 Corn Harvest:

|

Harvest Area

|

91.3 million acres

|

(98.8 m. acres planted, with harvest corresponding to 92.4% of acres planted)

|

|

Yield

|

186.5 bushels per acre

|

(Updated from 186.0 bushels per acre in the Dec. WASDE)

|

|

Beginning Stocks

|

1,551 m. bushels

|

|

|

Production

|

17,021 m. bushels

|

|

|

Imports

|

25 m. bushels

|

|

|

Total Supply

|

18,597 m. bushels

|

Proportion of Supply

|

|

Feed & Residual

|

6,200 m. bushels

|

33.3%

|

|

Food & Seed

|

1,370 m bushels

|

7.4%

|

|

Ethanol & Byproducts

|

5,600 m. bushels

|

30.1%

|

|

Domestic Use

|

13,170 m. bushels

|

70.8%

|

|

Exports

|

3,200 m. bushels

|

17.2%

|

|

Ending Stocks

|

2,227 m. bushels

|

12.0%

|

Average Farm Price: 410 cents per bushel. (Up 10 cents per bushel from the December WASDE)

SOYBEANS

Projections for soybeans were adjusted from the December WASDE to reflect the 2026 crop. Yield of 53.0 bushels per acre was retained but with a slightly higher area of 81.2 million acres planted compared to 2025. The January WASDE raised the projection of the 2026 soybean crop by 0.2 percent to 4,262 million bushels. Crush volume was raised 0.6 percent from December to 2,570 million bushels consistent with increased demand and industry capacity. Projected exports were reduced by 3.7 percent to 1,575 million bushels despite the prospect of increased imports by China following uncertainty over tariffs and diplomatic conflict. Ending stocks were anticipated to be 350 million bushels, up 20.7 percent from the December WASDE estimate. Prior to 2018, China, the largest trading partner for U.S. agricultural commodities, imported the equivalent of 25 percent of U.S. soybeans harvested.

The January USDA projection for the ex-farm seasonal price for soybeans was reduced 30 cents to 1,020 cents per bushel. At close of trading on January 12th following the noon release of the WASDE, the CME spot price was 1,050 cents per bushel, 2.9 percent above the January USDA projection and 3.5 percent below the December 9th CME price.

JANUARY 2026 WASDE #667 Summary for the 2026 Soybean Harvest:-

|

Harvest Area

|

80.4 million acres

|

81.2 m. acres planted. Harvest corresponding to 99.0% of planted acreage)

|

|

Yield

|

53.0 bushels per acre

|

(Updated from 53.5 bushels/acre in the September WASDE)

|

|

Beginning Stocks

|

325 m. bushels

|

|

|

Production

|

4,262 m. bushels

|

|

|

Imports

|

20 m. bushels

|

|

|

Total Supply

|

4,607 m. bushels

|

Proportion of Supply

|

|

Crush Volume

|

2,570 m. bushels

|

55.8%

|

|

Exports

|

1,575 m. bushels

|

34.2%

|

|

Seed

|

73 m. bushels

|

1.6%

|

|

Residual

|

39 m. bushels

|

0.8%

|

|

Total Use

|

4,257 m. bushels

|

92.4%

|

|

Ending Stocks

|

350 m. bushels

|

7.6%

|

Average Farm Price: 1,020 cents per bushel (Down 30 cents per bushel from the December WASDE)

SOYBEAN MEAL

The projected parameters for soybean meal were updated from the December WASDE. Production will be up 0.9 percent to 60.8 million tons, consistent with the 0.6 percent increase in soybean crush volume of 2,570 million bushels. Projected production reflects the stagnant demand for biodiesel despite expanded U.S. crushing capacity. Crush volume is driven both by exports and domestic consumption for livestock feed and for soy oil supplying the food and biodiesel segments. The projection of domestic use was 42.0 million tons. Exports were estimated at 19.4 million tons. The projected parameters for soybean meal were updated from the December WASDE. Production will be up 0.9 percent to 60.8 million tons, consistent with the 0.6 percent increase in soybean crush volume of 2,570 million bushels. Projected production reflects the stagnant demand for biodiesel despite expanded U.S. crushing capacity. Crush volume is driven both by exports and domestic consumption for livestock feed and for soy oil supplying the food and biodiesel segments. The projection of domestic use was 42.0 million tons. Exports were estimated at 19.4 million tons.

The USDA projected the ex-plant price of soybean meal at $295 per ton, down $5 per ton from the January WASDE as an average for the season based on supply and demand considerations. USDA predicted an ending stock of 450,000 tons representing 0.7 percent of supply.

At close of trading on January 12th the CME spot price for soybean meal was $298 per ton, up $3 per ton (1.0 percent) compared to the USDA projection of $295 per ton and down 1.0 percent from the December 9th CME price.

JANUARY 2026 WASDE #667 Projection of Soybean Meal Production and Use

Quantities in thousand short tons

|

Beginning Stocks

|

398

|

|

Production

|

60,752

|

|

Imports

|

725

|

|

Total Supply

|

61,350

|

|

Domestic Use

|

42,025

|

|

Exports

|

19,400

|

|

Total Use

|

61,425

|

|

Ending Stocks

|

450

|

Average Price ex plant: $295 per ton (Down $5 per ton from the December WASDE)

IMPLICATIONS FOR PRODUCTION COST

The price projections based on CME quotations for corn and soybeans suggest higher feed production costs for broilers and eggs. Going forward, prices of commodities will be determined by World supply and demand and U.S. domestic use and exports. The price projections based on CME quotations for corn and soybeans suggest higher feed production costs for broilers and eggs. Going forward, prices of commodities will be determined by World supply and demand and U.S. domestic use and exports.

For each 10 cents per bushel change in corn:-

- The cost of egg production would change by 0.45 cent per dozen

- The cost of broiler production would change by 0.25 cent per live pound

For each $10 per ton change in the cost of soybean meal:-

- The cost of egg production would change by 0.35 cent per doze

- The cost of broiler production would change by 0.30 cent per live pound.

WORLD SITUATION

With respect to world coarse grains and oilseeds the January 2026 WASDE Report included the following appraisals by USDA:-

COARSE GRAINS:

“Global coarse grain production for 2025/26 is forecast up 14.8 million tons to 1.591 billion.

This month’s foreign coarse grain outlook is for greater production, virtually unchanged trade, and higher ending stocks. Foreign corn production is forecast higher with an increase Global coarse grain production for 2025/26 is forecast up 14.8 million tons to 1.591 billion.

This month’s foreign coarse grain outlook is for greater production, virtually unchanged trade, and higher ending stocks. Foreign corn production is forecast higher with an increase for China, where production is raised to a record 301.2 million tons based on the latest data from the National Bureau of Statistics. Foreign corn ending stocks for 2025/26 are higher, mostly reflecting an increase for China. Global corn stocks, at 290.9 million tons, are raised 11.8 million.”

OILSEEDS:

“Foreign 2025/26 oilseed production is raised 2.4 million tons mainly on higher soybean production partly offset by lower cottonseed and rapeseed output. For sunflowerseed, higher production for Argentina is offset by lower production for Russia. Rapeseed production is also lowered for Russia”. “Foreign 2025/26 oilseed production is raised 2.4 million tons mainly on higher soybean production partly offset by lower cottonseed and rapeseed output. For sunflowerseed, higher production for Argentina is offset by lower production for Russia. Rapeseed production is also lowered for Russia”.

“The 2025/26 global soybean outlook includes higher production, increased crush, lower exports, and higher ending stocks. Global soybean production is increased 3.1 million tons to 425.7 million, reflecting higher crops for Brazil and the United States but lower output for China. Brazil soybean production is raised 3.0 million tons to 178.0 million on beneficial weather conditions in the Center West during the peak of the growing season. Further, positive early-season conditions and consistent rainfall in the south of Brazil also bolsters yield prospects, especially compared to previous years when the region faced drought. Soybean crush and soybean meal exports are raised for Brazil and the United States, and pairs with higher soybean meal imports for the European Union. EU soybean crush and soybean imports are lowered on higher imported soybean meal supplies. Global soybean exports for 2025/26 are reduced 0.1 million tons to 187.6 million as higher exports for Brazil are offset by lower U.S. shipments. Global ending stocks are increased 2.0 million tons to 124.4 million, mainly on higher stocks for the United States and Brazil.”

World and U.S. Data Combined for Coarse Grains and Oilseeds:-

|

Factor: Million m. tons

|

Coarse Grains

|

Oilseeds

|

|

Output

|

1,591*

|

693

|

|

Supply

|

1,914

|

835

|

|

World Trade

|

250

|

215

|

|

Use

|

1,592

|

579

|

|

Ending Stocks

|

322

|

145

|

*Values rounded to one million metric ton

(1 metric ton corn= 39.37 bushels. 1 metric ton of soybeans = 36.74 bushels)

(“ton” represents 2,000 pounds)

|

Updated USDA-ERS January 2026 Poultry Meat Projection

|

|

On January 16th 2025 the USDA-Economic Research Service released updated production and consumption data with respect to broilers and turkeys, covering 2024, a projection for 2025 and a forecast for 2026. On January 16th 2025 the USDA-Economic Research Service released updated production and consumption data with respect to broilers and turkeys, covering 2024, a projection for 2025 and a forecast for 2026.

The revised 2025 projection for broiler production is for 48,046 million lbs. (22.003 million metric tons) up 3.0 percent from 2024. USDA projected per capita consumption of 103.0 lbs. (46.8 kg.) for 2025, up 1.9 percent from 2024. Exports will attain 6,645 million lbs. (3,020 million metric tons), 0.5 percent below the previous year.

The 2026 USDA forecast for broiler production will be 48,600 million lbs. (22.090 million metric tons) up 1.2 percent from 2025 with per capita consumption up 0.7 lb. to 103.7 lbs. (47.1 kg). Exports will be 1.1 percent higher compared to 2025 at 6,715 million lbs. (3.052 million metric tons), equivalent to 13.8 percent of production.

Production values for the broiler and turkey segments of the U.S. poultry meat industry are tabulated below:-

|

Parameter

|

2024

(actual)

|

2025

(projection)

|

2026

(forecast)

|

Difference

2024 to 2025

|

|

Broilers

|

|

|

|

|

|

Production (million lbs.)

|

46,994

|

48,046

|

48,600

|

+2.3

|

|

Consumption (lbs. per capita)

|

101.1

|

103.0

|

103.7

|

+1.9

|

|

Exports (million lbs.)

|

6,680

|

6,645

|

6,715

|

-0.5

|

|

Proportion of production (%)

|

14.2

|

13.8

|

13.8

|

-2.8

|

|

|

|

|

|

|

|

Turkeys

|

|

|

|

|

|

Production (million lbs.)

|

5,121

|

4,832

|

4,975

|

-5.6

|

|

Consumption (lbs. per capita)

|

13.8

|

13.1

|

13.3

|

-5.1

|

|

Exports (million lbs.)

|

486

|

412

|

400

|

-15.2

|

|

Proportion of production (%)

|

9.5

|

8.5

|

8.6

|

-10.5

|

Source: Livestock, Dairy and Poultry Outlook released January 16th 2065

The January 16th USDA report updated the projection for the turkey industry during 2025 including annual production of 4,832 million lbs. (2.196 million metric tons), down 5.6 percent from 2024. Consumption in 2025 is projected to be 13.1 lbs. (6.0kg.) per capita, down by 5.3 percent from the previous year. Export volume will attain 412 million lbs. (187,272 metric tons) in 2025. Values for production and consumption of RTC turkey in 2025 are considered to be realistic, given year to date data, the prevailing economy, variable weekly poult placements, production levels, losses from HPAI and inventories consistent with season.

The 2026 forecast for turkey production is 4,975 million lbs. (2.261 million metric tons) up an optimistic 3.0 percent from 2025 with per capita consumption up 1.5 percent to 13.3 lbs. (6.1 kg). Exports will be 2.9 percent lower than in 2025 to 400 million lbs. (181,81 metric tons) equivalent to 8.0 percent of production. This implies a reduction in selling prices for whole birds and products

Export projections do not allow for a breakdown in trade relations with existing major partners including Mexico, Canada and China nor the impact of catastrophic diseases including HPAI and vvND in either the U.S. or importing nations.

|

Poland Criticized in E.U. Audit

|

|