|

Poultry Industry News

|

Preamble

|

01/22/2026 |

|

Barbara and I supported by our Sponsor VAL-CO Industries wish our subscribers and friends in the industry a productive and enjoyable IPPE and a safe return. Regrettably we will not be with you at the 2026 event but hope to meet with you at PEAK in April

Simon

|

Monthly Broiler Production Statistics, December-January.

|

01/20/2026 |

|

Broiler Chick Placements December 2025-January 2026

According to the January 14th 2026 USDA Broiler Hatchery Report, 1,510 million eggs were set over six weeks extending from December 6th 2025 through January 10th 2026 inclusive. This was approximately one percent higher compared to the corresponding period in 2024/5. According to the January 14th 2026 USDA Broiler Hatchery Report, 1,510 million eggs were set over six weeks extending from December 6th 2025 through January 10th 2026 inclusive. This was approximately one percent higher compared to the corresponding period in 2024/5.

Total chick placements for the U.S. over the six-week period amounted to 1,177 million chicks. Claimed hatchability for the period averaged 79.7 percent for eggs set three weeks earlier. Each 1.0 percent change in hatchability represents approximately 1.93 million chicks placed per week and 1.83 million broilers processed, assuming five percent culls and mortality and within the current range of weekly settings.

Cumulative chick placements for the period January 4th through December 27th 2025 amounted to 10.00 billion chicks up approximately one percent from calendar 2024. For the first two hatch weeks of 2026 chick placements attained 0.39 billion, up one percent from the corresponding value in 2025.

According to the December 19th 2025 edition of USDA Chickens and Eggs, pullet breeder chicks hatched and intended for U.S. placement during November 2025 amounted to 8.08 million, down 2.2 percent (0.19 million pullet chicks) from November 2024 and 3.7 percent (288,000 pullet chicks) more than the previous month of October 2025. Broiler breeder hen complement attained 59.82 million in November 2025, 1.6 percent (1.00 million hens) down from December 2024 and 1.7 percent (988,000 hens) higher than October 2025.

Broiler Production 2026

As documented in the January 15th 2026 USDA Weekly Poultry Slaughter Reports for the processing week ending January 10th 2025, 173.6 million broilers were processed at 6.69 lbs. live. This was 12.7 percent more than the 154.1 million processed during the corresponding week in January 2025, constrained by holiday schedule. Broilers processed for the first two weeks in 2026 amounted to 0.32 million, 10.1percent more than for the corresponding period in 2025.

Ready to cook (RTC) weight for the most recent week in January was 881.6 million lbs. (400,727 metric tons). This was 12.6 percent more than the 783.2 million lbs. during the corresponding week in January 2025. Dressing percentage was a nominal 76.0 percent. For 2026 to date RTC broiler production attained 1,603 million lbs. (0,728 million metric tons). This quantity was 8.7 percent more than for the corresponding period in 2024.

The USDA posted live-weight data for the past week ending January 10th and YTD 2026 including:-

|

Live Weight Range (lbs.)

|

<4.25

|

4.26-6.25

|

6.26-7.25

|

>7.76

|

|

Proportion past week (%)

|

16

|

27

|

25

|

32

|

|

Change from 2020 YTD (%)

|

0

|

+2

|

+32

|

+6

|

Inventory and processing data for December 2025 has yet to be released by USDA at the time of compilation of this report

November 2025 Frozen Inventory

According to the December 23rd 2025 USDA Cold Storage Report, the first to be released after the Federal shutdown, stocks of broiler products as of November 30th 2025 compared to November 30th 2024 showed differences with respect to the following categories:-

- Total Chicken category attained 814.9 million lbs. (370.4 thousand metric tons) corresponding to approximately one week of production based on recent weekly RTC output. The November 2025 inventory was up 0.7 percent compared to 809,039 million lbs. (368.8 thousand metric tons) on November 30th 2024 and up 0.4 percent from the previous month of October 2025.

- Leg Quarters were down 16.0 percent to 55.6 million lbs. compared to November 30th 2024 consistent with the data on exports. Inventory was up 2.0 percent from July 31st 2025. Given the trend in inventory of leg quarters it is evident that this category continues to be shipped in varying quantities as the principal (96 percent) chicken export product to a number of nations.

- The Breasts and Breast Meat category was up 2.8 percent from November 30th 2024 to 242.1 million lbs. indicating a relatively lower domestic consumer demand for this category despite concern over inflation in the cost of alternative proteins. The November 30th 2025 stock level was 2.1 percent higher than October 31st 2025. The trend through the first eleven months of 2025 suggests stable but low retail and food service demand for the white meat category. This is despite promotion of chicken sandwiches and wraps by QSRs in the face of a higher cost for beef coupled with an increasing pattern of eat-at-home consumption.

- Total inventory of dark meat (drumsticks legs, thighs and thigh quarters but excluding leg quarters) on November 30th 2025 decreased 3.6 percent from November 30th 2024 to 65.9 million lbs. This difference suggests an increase in domestic demand for lower-priced dark meat against the prevailing price of white chicken meat. Higher prices for competitive proteins offer an opportunity to increase domestic demand for this category with innovative product development and promotion.

- Wings showed a 3.8 percent decrease from November 30th 2024, contributing to a stock of 57.1 million lbs. Inventory of wings was 5.2 percent lower compared to the end of October 2025. Movement in stock over the past 12 months has demonstrated slightly higher demand for this category despite competition from “boneless wings.” Increased consumption traditionally associated with significant sports events including the College and Super Bowls reduced the volumes of storage in January and February 2025. The progressive increase in unit price during 2024 plateaued in 2025 due to consumer fatigue and competition from competing protein snacks despite continued interest in professional and collegiate football.

- The inventory of Paws and Feet was 15.8 percent lower than on November 30th 2024 to 27.6 million lbs. Stock was 3.0 percent higher than on October 31st 2025. Prior to the April 2020 Phase-1 Trade Agreement approximately half of the shipments of paws and feet destined for Hong Kong were landed and transshipped to the Mainland, a trend that is re-emerging.

- The Other category comprising 345.0 million lbs. on November 30th 2025 was up 4.1 percent from November 30th 2024 but represented a substantial 42.3 percent of inventory. The high proportion of the Other category suggests further classification or re-allocation by USDA to the designated major categories.

November 2025 Processed Broiler Production

The delayed monthly USDA Poultry Slaughter Report was released on December 5th 2025 covering October 2025, with the NASS having skipped September due to the Federal shutdown in October. The month comprised 23 working days, the same as November 2024. The following values were documented for the month of October:-

- A total of 870.1 million broilers were processed in October 2025, up 8.4 million or 1.0 percent from August 2024;

- Total live weight in August 2025 was 5,304 million lbs., down 38.7 million lbs. or 0.7 percent from October 2024;

- Unit live weight in October 2025 was 6.72 lbs., up 0.02lb. (0.3 percent) from October 2024.

- RTC in October 2025 attained 4,426 million lbs., up 55.9 million lbs. or 1.3 percent from October 2004.

- WOG yield in October 2025 was 75.7 percent, down from 75.8 percent in October 2024.

- The proportion marketed as chilled in October 2025 comprised 92.9 percent of RTC output compared to 93.3 percent in October 2024.

- Ante-mortem condemnation as a proportion of live weight attained 0.19 percent during October 2025 down from 0.17 percent in October 2024.

- Post-mortem condemnations as a proportion of processed mass corresponded to 0.41 percent during October 2025 compared to 0.44 percent in October 2024.

Comments

Mexico has recognized the OIE principle of regionalization after intensive negotiations between SENASICA and the U.S. counterpart, USDA-APHIS assisted by USAPEEC. Provided importing nations adhere to OIE guidelines on regionalization, localized outbreaks of avian influenza or possibly Newcastle disease will affect exports only from states or counties with outbreaks in commercial flocks. The response of China, Japan and some other nations is less predictable with bans placed on a nationwide or statewide basis. The response by China to outbreaks is influenced more by self-interest than considerations of scientific fact or international trade obligations. Other importing nations have confined restrictions to counties following the WOAH principle of regionalization. The challenge facing the U.S. as the second largest exporting nation after Brazil, will be to gain acceptance for controlled vaccination against HPAI in specific industry sectors and regions with appropriate surveillance and certification to the satisfaction of importing nations.

|

Updated USDA-ERS January 2026 Poultry Meat Projection

|

01/16/2026 |

|

On January 16th 2025 the USDA-Economic Research Service released updated production and consumption data with respect to broilers and turkeys, covering 2024, a projection for 2025 and a forecast for 2026. On January 16th 2025 the USDA-Economic Research Service released updated production and consumption data with respect to broilers and turkeys, covering 2024, a projection for 2025 and a forecast for 2026.

The revised 2025 projection for broiler production is for 48,046 million lbs. (22.003 million metric tons) up 3.0 percent from 2024. USDA projected per capita consumption of 103.0 lbs. (46.8 kg.) for 2025, up 1.9 percent from 2024. Exports will attain 6,645 million lbs. (3,020 million metric tons), 0.5 percent below the previous year.

The 2026 USDA forecast for broiler production will be 48,600 million lbs. (22.090 million metric tons) up 1.2 percent from 2025 with per capita consumption up 0.7 lb. to 103.7 lbs. (47.1 kg). Exports will be 1.1 percent higher compared to 2025 at 6,715 million lbs. (3.052 million metric tons), equivalent to 13.8 percent of production.

Production values for the broiler and turkey segments of the U.S. poultry meat industry are tabulated below:-

|

Parameter

|

2024

(actual)

|

2025

(projection)

|

2026

(forecast)

|

Difference

2024 to 2025

|

|

Broilers

|

|

|

|

|

|

Production (million lbs.)

|

46,994

|

48,046

|

48,600

|

+2.3

|

|

Consumption (lbs. per capita)

|

101.1

|

103.0

|

103.7

|

+1.9

|

|

Exports (million lbs.)

|

6,680

|

6,645

|

6,715

|

-0.5

|

|

Proportion of production (%)

|

14.2

|

13.8

|

13.8

|

-2.8

|

|

|

|

|

|

|

|

Turkeys

|

|

|

|

|

|

Production (million lbs.)

|

5,121

|

4,832

|

4,975

|

-5.6

|

|

Consumption (lbs. per capita)

|

13.8

|

13.1

|

13.3

|

-5.1

|

|

Exports (million lbs.)

|

486

|

412

|

400

|

-15.2

|

|

Proportion of production (%)

|

9.5

|

8.5

|

8.6

|

-10.5

|

Source: Livestock, Dairy and Poultry Outlook released January 16th 2065

The January 16th USDA report updated the projection for the turkey industry during 2025 including annual production of 4,832 million lbs. (2.196 million metric tons), down 5.6 percent from 2024. Consumption in 2025 is projected to be 13.1 lbs. (6.0kg.) per capita, down by 5.3 percent from the previous year. Export volume will attain 412 million lbs. (187,272 metric tons) in 2025. Values for production and consumption of RTC turkey in 2025 are considered to be realistic, given year to date data, the prevailing economy, variable weekly poult placements, production levels, losses from HPAI and inventories consistent with season.

The 2026 forecast for turkey production is 4,975 million lbs. (2.261 million metric tons) up an optimistic 3.0 percent from 2025 with per capita consumption up 1.5 percent to 13.3 lbs. (6.1 kg). Exports will be 2.9 percent lower than in 2025 to 400 million lbs. (181,81 metric tons) equivalent to 8.0 percent of production. This implies a reduction in selling prices for whole birds and products

Export projections do not allow for a breakdown in trade relations with existing major partners including Mexico, Canada and China nor the impact of catastrophic diseases including HPAI and vvND in either the U.S. or importing nations.

|

Advance announcement for PEAK in Mid-April

|

01/16/2026 |

|

The 2026 Peak Exhibition organized by the Midwest Poultry Federation will take place over April 14 through 16 in the Minneapolis Convention Center. The 2026 Peak Exhibition organized by the Midwest Poultry Federation will take place over April 14 through 16 in the Minneapolis Convention Center.

The program will include the progressively-expanding tradeshow incorporating TED talks. Other program activities will comprise educational sessions, entertainment coupled with fellowship and collegial interaction. The program will include the progressively-expanding tradeshow incorporating TED talks. Other program activities will comprise educational sessions, entertainment coupled with fellowship and collegial interaction.

|

Aldi Expansion in 2026

|

01/15/2026 |

|

Aldi will expand in the U.S. during the 50th year of operation in the U.S. with 180 new locations including Maine together with new distribution centers in Florida, Arizona and Colorado. At the end of 2025, Aldi operated Aldi will expand in the U.S. during the 50th year of operation in the U.S. with 180 new locations including Maine together with new distribution centers in Florida, Arizona and Colorado. At the end of 2025, Aldi operated 2,614 stores in the U.S. with a goal of 3,200 locations by the end of 2028 requiring capital investment of $9 billion on stores and logistics. 2,614 stores in the U.S. with a goal of 3,200 locations by the end of 2028 requiring capital investment of $9 billion on stores and logistics.

According to Atty McGrath, CEO of Aldi U.S. as quoted by CNBC “Consumers now really are not looking for fancy stores and tens of thousands of different items to choose from.” She added, “They are really savvy shoppers. They know that private labels can save them money without sacrificing quality.”

Industry analysts credit Aldi with an eight percent increase in store traffic during 2025, outpacing conventional supermarkets and adding 17 million new customers.

|

Settlement Over Wage Suppression Lawsuit

|

01/15/2026 |

|

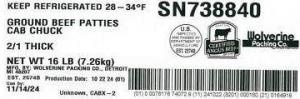

On January 8th, defendant Agri Stats Inc. settled with plaintiffs alleging price fixing by major red-meat packers.* On January 8th, defendant Agri Stats Inc. settled with plaintiffs alleging price fixing by major red-meat packers.*  The Greater Omaha Packing Company was the fourteenth defendant to reach an agreement in the case leaving only Smithfield Foods apparently willing to go to trial at this time. Settlement values have amounted to $202.8 million ranging from $100,000 for the Greater Omaha Packing Company to $72.5 million for Tyson Foods with JBS USA Food Company settling for $55 million and Cargill Inc. at $29.8 million representing the largest settlements. The Greater Omaha Packing Company was the fourteenth defendant to reach an agreement in the case leaving only Smithfield Foods apparently willing to go to trial at this time. Settlement values have amounted to $202.8 million ranging from $100,000 for the Greater Omaha Packing Company to $72.5 million for Tyson Foods with JBS USA Food Company settling for $55 million and Cargill Inc. at $29.8 million representing the largest settlements.

Plaintiffs’ attorneys have requested the Court of Jurisdiction to approval final settlement agreements with Greater Omaha and Agri Stats. This Company will not pay any monetary value but will cooperate in litigating claims against Smithfield Foods for the alleged or actual “conspiracy or agreement between defendants relating to reducing competition in the hiring and  retaining of or to fix, depress, restrain or exchange information, otherwise reducing the compensation paid.” retaining of or to fix, depress, restrain or exchange information, otherwise reducing the compensation paid.”

*Civil Action #1: 22-cv-02946-PAB-STV

|

U.S. Broiler and Turkey Exports, January Through October 2025.

|

01/15/2026 |

|

OVERVIEW OVERVIEW

Total exports of bone-in broiler parts and feet during January-October 2025 attained 2,585,961 metric tons, 4.1 percent lower than in January-October 2024 (2,697,121 metric tons). Total value of broiler exports increased by 0.7 percent to $3,883 million ($3,856 million).

Total export volume of turkey products during January-October 2025 attained 155,960 metric tons, 15.6 percent less than in January-October 2024 (184,727 metric tons). Total value of turkey exports increased by 14.5 percent to $636 million ($555 million).

Average unit price attained by the broiler industry is constrained by the fact that leg quarters comprise over 96 percent of broiler meat exports by volume (excluding feet). Leg quarters represent a relatively low-value undifferentiated commodity lacking in pricing power. Exporters of commodities are subjected to competition from domestic production in importing nations. Generic products such as leg quarters are vulnerable to trade disputes and embargos based on real or contrived disease restrictions. To increase sales volume and value the U.S. industry will have to become more customer-centric offering value-added presentations with attributes required by importers. Whether this will increase margins is questionable given that leg quarters are regarded as a by-product of broiler production. A more profitable long-term strategy for the U.S. industry would be to develop products using dark meat to compete with and displace pork and beef in the domestic retail and institutional markets. Due to a shortage and hence high price for beef presentations this opportunity is now evident.

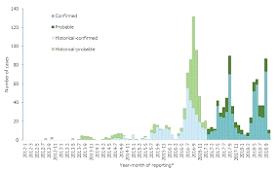

HPAI is now accepted to be panornitic affecting the poultry meat industries of six continents with seasonal and sporadic outbreaks. The incidence rate and location of cases in the U.S. has limited the eligibility for export from many plants depending on restrictions imposed by importing nations. Incident cases in the U.S. have continued at a low rate in egg-production flocks and in turkeys but a resurgence is anticipated during the first quarter of 2026.

Uncertainty surrounding tariff policy is an added complication potentially impacting export volume in 2026. In the event of reduced exports, leg quarters would be diverted to the domestic market resulting in a depression in average value derived from a processed bird.

To offset an anticipated decline in exports of U.S. agricultural products the USDA will make available $285 million during 2026 for trade promotion including trade reciprocity missions and credit guarantees under the GSM-102 program.

EXPORT VOLUMES AND PRICES FOR BROILER MEAT

The following table prepared from USDA data circulated by the USAPEEC, compares values for poultry meat exports during January-October 2025 compared with the corresponding months during 2024:-

|

PRODUCT

|

Jan.-Oct. 2024

|

Jan.-Oct. 2025

|

DIFFERENCE

|

|

Broiler Meat & Feet

|

|

|

|

|

Volume (metric tons)

|

2,697,121

|

2,585,961

|

-111,160 (-4.1%)

|

|

Value ($ millions)

|

3,856

|

3,883

|

+27 (+0.7%)

|

|

Unit value ($/m. ton)

|

1,430

|

1,502

|

+72 (+5.0%)

|

|

Turkey Meat

|

|

|

|

|

Volume (metric tons)

|

184,727

|

155,960

|

-28,767 (-15.6%)

|

|

Value ($ millions)

|

555

|

636

|

+81 (+14.5%)

|

|

Unit value ($/m. ton)

|

3,005

|

4,078

|

+1.073 (+35.7%)

|

COMPARISON OF U.S. CHICKEN AND TURKEY EXPORTS

JANUARY-OCTOBER 2025 COMPARED TO 2024

BROILER EXPORTS

Total broiler parts, predominantly leg quarters but including feet, exported during January-October 2025 compared with the corresponding months in 2024 declined by 4.1 percent in volume but value was up 0.7 percent. Unit value was 5.0 percent higher to $1,502 per metric ton.

During 2024 exports attained 3,251,000 metric tons valued at $4,689 million, down 10.5 percent in volume and down 1.1 percent in value compared to 2023. Unit value was up 10.7 percent to $1,442 per metric ton

Broiler imports in 2025 are projected to attain an inconsequential 67,000 metric tons (134 million lbs.) compared to 82,000 metric tons (180,000 million lbs.) in 2024

The top five importers of broiler meat represented 51.1 percent of shipments during January-October 2025. The top ten importers comprised 69.3 percent of the total volume reflecting concentration among the significant importing nations.

Eighth-ranked China declined 43.1 percent in volume to 78,306 tons and concurrently by 31.3 percent in value to $242 million over the first ten months of 2025 compared to the corresponding period in 2024. Unit value increased by 20.9 percent to $3,093 per metric ton reflecting the high proportion of feet in consignments

Nations gaining in volume compared to the corresponding period in 2024 (with the percentage change indicated) in descending order of volume with ranking indicated by numeral were:-

2. Taiwan, (+35%); 4. Philippines, (+31%); 5. Canada, (+15%); 10. Haiti, (+27%); 11. Ghana, (+16%); 13, Dominican Rep., (+1%) and 17. Congo-Kinshasa), (+85%)

Losses during January-October 2025 offset the gains in exports with declines for:-

1. Mexico, (-8%); 3. Cuba, (-10%); 6. Guatemala, (-1%); 7. Angola, (-19%);

8. China, (-43%); 9. Viet Nam, (-31); 12. UAE, (-6%); 14. Hong Kong, (-38%)

and 15. Georgia, (-23%).

TURKEY EXPORTS

The volume of turkey meat exported during January-October 2025 declined by 15.6 percent to 155,960 metric tons from January-October 2024 but value was 14.5 percent higher at $636 million. Average unit value was 35.7 percent higher at $4,078 per metric ton.

Imports of turkey products attained 15,000 metric tons (33 million lbs.) in 2024 with a similar projection for 2025.

Mexico imported 124,127 tons during the 10-month period representing 79.6 percent of volume. Value attained $506 million comprising 79.6 percent of value at a unit price of $4,073 per ton. Canada imported 5,065 tons valued at $18 million with a unit price of $3,514 per ton.

It is important to recognize that exports of chicken and turkey meat products to our USMCA partners amounted to $1,264 million in 2021, $1,647 million during 2022, $1,696 in 2023 and $1,732 million over the first ten-months of 2025. It will be necessary for all three parties to the USMCA to respect the terms of the Agreement in good faith since punitive action against Mexico or Canada on issues unrelated to poultry products will result in reciprocal action by our trading partners to the possible detriment of U.S. agriculture. This is especially important as all three nations have recently elected chief executives and administrations.

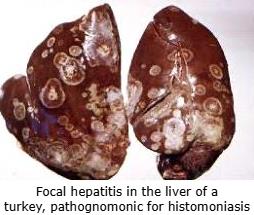

The emergence of H5N1strain avian influenza virus with a Eurasian genome in migratory waterfowl in all four Flyways of the U.S. during 2022 was responsible for sporadic outbreaks of avian influenza in backyard flocks and serious commercial losses in egg-producing complexes and turkey flocks but to a lesser extent in broilers. The probability of additional outbreaks of HPAI over succeeding weeks appears likely with recorded outbreaks in turkey farms in ND, SD and MN. Consistent with fall migration of waterfowl. Incident cases affecting egg-production and turkey flocks will be a function of shedding by migratory and domestic birds and possibly free-living mammals or even extension from dairy herds. Protection of commercial flocks at present relies on the intensity and efficiency of biosecurity including wild-bird laser repellant installations, representing investment in structural improvements and operational procedures. These measures are apparently inadequate to provide absolute protection, suggesting the need for preventive vaccination in high-risk areas for egg-producing, breeder and turkey flocks.

The application of restricted county-wide embargos following the limited and regional cases of HPAI in broilers with restoration of eligibility 28 days after decontamination has supported export volume for the U.S. broiler industry. Exports of turkey products were more constrained with plants processing turkeys in Minnesota, the Dakotas, Wisconsin and Iowa impacted. The future challenge will be to gain acceptance for limited preventive vaccination of laying hens and turkeys in high-risk areas accompanied by intensive surveillance. It is now accepted that H5N1 HPAI is panornitic in distribution among commercial and migratory birds across six continents. The infection is now seasonally or regionally endemic in many nations with intensive poultry production, suggesting that vaccination will have to be accepted among trading partners as an adjunct to control measures in accordance with WOAH policy.

The live-bird market system supplying metropolitan areas, the presence of numerous backyard flocks, gamefowl and commercial laying hens allowed outside access, potentially in contact with migratory and now some resident bird species, all represent an ongoing danger to the entire U.S. commercial industry. The live-bird segments of U.S. poultry production represent a risk to the export eligibility of the broiler and turkey industries notwithstanding WOAH compartmentalization for breeders and regionalization (zoning) to counties or states for commercial production.

|

Shuttered Cargill Turkey Plant to be Repurposed by Tyson Foods

|

01/15/2026 |

|

On December 5th, Tyson Foods acquired the former Cargill turkey processing plant in Springdale, AR. for $23 million. The facility is located on a 45-acre property and is approximately 350,000 square feet in extent. On December 5th, Tyson Foods acquired the former Cargill turkey processing plant in Springdale, AR. for $23 million. The facility is located on a 45-acre property and is approximately 350,000 square feet in extent.

Tyson Foods intends to convert the plant to further-processing requiring an investment of between $100 and $130 million.

Industry observers suggest that Cargill intends to withdraw from turkey production in the U.S. but without confirmation from the Company. Cargill will maintain a presence in the poultry industry through its joint-venture investment in Wayne-Sanderson Farms.

|

New Appointments at USDA-APHIS

|

01/14/2026 |

|

On January 12th the U.S. Department of Agriculture announced leadership appointments within the Animal Plant Health Inspection Service (APHIS). Dr. Michael Watson the Administrator of the Agency will retire at the January. Dr. Rosemary Sifford Deputy Administrator for Veterinary Services and U.S. Chief Veterinary Officer recently retired. On January 12th the U.S. Department of Agriculture announced leadership appointments within the Animal Plant Health Inspection Service (APHIS). Dr. Michael Watson the Administrator of the Agency will retire at the January. Dr. Rosemary Sifford Deputy Administrator for Veterinary Services and U.S. Chief Veterinary Officer recently retired.

Their replacements will be Ms. Kelly Moore who will serve as Acting Administrator of APHIS and Dr. Alan Huddleston who will serve as the Acting U.S. Chief Veterinary Officer. Dr. Adis Dijab Associate Deputy Administrator of APHIS will provide operational oversight and continuity.

Ms. Moore is currently Acting Chief Operating Officer for USDA Marketing and Regulatory Programs and is a veteran of the U.S. Marines. Dr. Alan Huddleston has extensive experience in epidemiology and program development and will continue the tradition of strong cooperation in the international arena and will cooperate with states and the U.S. livestock and poultry industries.

|

USDA-WASDE REPORT #667. January 12th 2026

|

01/12/2026 |

|

OVERVIEW OVERVIEW

Understandably the January 12th edition of the World Agriculture Supply and Demand Estimates (WASDE) #667 projecting the 2026 season was extensively revised with respect to corn and soybeans from the previous post-shutdown December 9th edition reflecting the 2025 crop. Crop size and ending stocks were derived from previous harvest data, projections for domestic use and the effect of tariff policy and competition that influence export volumes

The January WASDE report projected that the 2026 corn crop will be harvested from an expanded 91.3 million acres, (90.0 million acres in 2025). The soybean crop will be harvested from an almost unchanged 80.4 million acres, (80.3 million acres in 2025).

The January WASDE yield value for the 2026 corn crop was raised 0.5 bushels to 186.5 bushels per acre. By comparison corn yield was 183.1 bushels per acre in 2024. Soybean yield was held at 53.0 bushels per acre, unchanged from 2025 reflecting previous harvests. By comparison soybean yield was 51.7 bushels per acre for the 2024 crop.

The January WASDE projection for the 2026 ending stock of corn was raised by 9.8 percent from December to 2,227 million bushels. The January USDA projection for the 2026 ending stock of soybeans was raised 20.7 percent from December to 350 million bushels consistent with domestic use and export projections.

The January WASDE raised the projected corn price for the 2026-2027 market year by 10 cents to an average of 410 cents per bushel. The projected average season price for soybeans was lowered by 30 cents to 1,020 cents per bushel. The price of soybean meal was lowered from the December WASDE by $5 to $295 per ton.

USDA commodity prices suggest stable feed costs for livestock and poultry producers given projections for yields, domestic use and exports. In some areas return from corn will be below break-even given relative yields, production costs and depressed per bushel prices. The USDA has announced an allocation of $12 billion to row-crop farmers to compensate for prolonged low commodity prices resulting from reduced exports occasioned by tariffs imposed by the U.S.

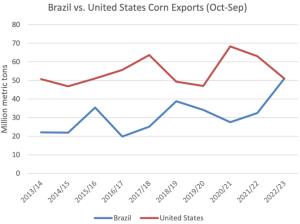

Projections for world output included in the January 2026 WASDE report, reflect the most recent estimates for the production and export of commodities especially in the Southern Hemisphere with an emphasis on volumes and prices offered by Argentine and Brazil. Economists also consider the impact of weather patterns arising from Southern Oscillation events especially on Brazil and Argentina.

It is accepted that USDA projections for exports will be influenced by the fluid situation relating to tariffs. Estimates of exports are also based on the perceived intentions and needs of China. This Nation sharply curtailed purchases of commodities and especially U.S. soybeans since the 2024-2025 market year and the current year to date.

CORN

Production parameters for corn were updated from the December WASDE, reflecting the predicted yield, and updated projections for domestic use and trade. The January WASDE Report projected a 2026 crop of 17,021 million bushels, compared to 16,752 million bushels for the previous 2025 record harvest. The “Feed and Residual” category was raised 100 million bushels. (1.6 percent) for 2026 to 6,200 million bushels. The Food and Seed category was projected at 1,370 million bushels down 10 million bushels. The Ethanol and Byproducts Category was retained at 5,600 million bushels consistent with estimated demand for E-10 and higher blends for driving needs during winter months. Projected corn exports were held at 3,300 million bushels, based on recent orders and shipments. The anticipated ending stock of corn will be up 9.8 percent to 2,227 million bushels or 12 percent of projected availability. Production parameters for corn were updated from the December WASDE, reflecting the predicted yield, and updated projections for domestic use and trade. The January WASDE Report projected a 2026 crop of 17,021 million bushels, compared to 16,752 million bushels for the previous 2025 record harvest. The “Feed and Residual” category was raised 100 million bushels. (1.6 percent) for 2026 to 6,200 million bushels. The Food and Seed category was projected at 1,370 million bushels down 10 million bushels. The Ethanol and Byproducts Category was retained at 5,600 million bushels consistent with estimated demand for E-10 and higher blends for driving needs during winter months. Projected corn exports were held at 3,300 million bushels, based on recent orders and shipments. The anticipated ending stock of corn will be up 9.8 percent to 2,227 million bushels or 12 percent of projected availability.

The forecast USDA average season farm price for corn in the January WASDE report was 410 cents per bushel. At close of trading after the noon January 12th release of the WASDE, the CME spot price for corn was 421 cents per bushel, 2.7 percent above the USDA projection and 6.0 percent below the December 9th CME price.

JANUARY 2026 WASDE #667 Summary for the 2025 Corn Harvest:

|

Harvest Area

|

91.3 million acres

|

(98.8 m. acres planted, with harvest corresponding to 92.4% of acres planted)

|

|

Yield

|

186.5 bushels per acre

|

(Updated from 186.0 bushels per acre in the Dec. WASDE)

|

|

Beginning Stocks

|

1,551 m. bushels

|

|

|

Production

|

17,021 m. bushels

|

|

|

Imports

|

25 m. bushels

|

|

|

Total Supply

|

18,597 m. bushels

|

Proportion of Supply

|

|

Feed & Residual

|

6,200 m. bushels

|

33.3%

|

|

Food & Seed

|

1,370 m bushels

|

7.4%

|

|

Ethanol & Byproducts

|

5,600 m. bushels

|

30.1%

|

|

Domestic Use

|

13,170 m. bushels

|

70.8%

|

|

Exports

|

3,200 m. bushels

|

17.2%

|

|

Ending Stocks

|

2,227 m. bushels

|

12.0%

|

Average Farm Price: 410 cents per bushel. (Up 10 cents per bushel from the December WASDE)

SOYBEANS

Projections for soybeans were adjusted from the December WASDE to reflect the 2026 crop. Yield of 53.0 bushels per acre was retained but with a slightly higher area of 81.2 million acres planted compared to 2025. The January WASDE raised the projection of the 2026 soybean crop by 0.2 percent to 4,262 million bushels. Crush volume was raised 0.6 percent from December to 2,570 million bushels consistent with increased demand and industry capacity. Projected exports were reduced by 3.7 percent to 1,575 million bushels despite the prospect of increased imports by China following uncertainty over tariffs and diplomatic conflict. Ending stocks were anticipated to be 350 million bushels, up 20.7 percent from the December WASDE estimate. Prior to 2018, China, the largest trading partner for U.S. agricultural commodities, imported the equivalent of 25 percent of U.S. soybeans harvested.

The January USDA projection for the ex-farm seasonal price for soybeans was reduced 30 cents to 1,020 cents per bushel. At close of trading on January 12th following the noon release of the WASDE, the CME spot price was 1,050 cents per bushel, 2.9 percent above the January USDA projection and 3.5 percent below the December 9th CME price.

JANUARY 2026 WASDE #667 Summary for the 2026 Soybean Harvest:-

|

Harvest Area

|

80.4 million acres

|

81.2 m. acres planted. Harvest corresponding to 99.0% of planted acreage)

|

|

Yield

|

53.0 bushels per acre

|

(Updated from 53.5 bushels/acre in the September WASDE)

|

|

Beginning Stocks

|

325 m. bushels

|

|

|

Production

|

4,262 m. bushels

|

|

|

Imports

|

20 m. bushels

|

|

|

Total Supply

|

4,607 m. bushels

|

Proportion of Supply

|

|

Crush Volume

|

2,570 m. bushels

|

55.8%

|

|

Exports

|

1,575 m. bushels

|

34.2%

|

|

Seed

|

73 m. bushels

|

1.6%

|

|

Residual

|

39 m. bushels

|

0.8%

|

|

Total Use

|

4,257 m. bushels

|

92.4%

|

|

Ending Stocks

|

350 m. bushels

|

7.6%

|

Average Farm Price: 1,020 cents per bushel (Down 30 cents per bushel from the December WASDE)

SOYBEAN MEAL

The projected parameters for soybean meal were updated from the December WASDE. Production will be up 0.9 percent to 60.8 million tons, consistent with the 0.6 percent increase in soybean crush volume of 2,570 million bushels. Projected production reflects the stagnant demand for biodiesel despite expanded U.S. crushing capacity. Crush volume is driven both by exports and domestic consumption for livestock feed and for soy oil supplying the food and biodiesel segments. The projection of domestic use was 42.0 million tons. Exports were estimated at 19.4 million tons. The projected parameters for soybean meal were updated from the December WASDE. Production will be up 0.9 percent to 60.8 million tons, consistent with the 0.6 percent increase in soybean crush volume of 2,570 million bushels. Projected production reflects the stagnant demand for biodiesel despite expanded U.S. crushing capacity. Crush volume is driven both by exports and domestic consumption for livestock feed and for soy oil supplying the food and biodiesel segments. The projection of domestic use was 42.0 million tons. Exports were estimated at 19.4 million tons.

The USDA projected the ex-plant price of soybean meal at $295 per ton, down $5 per ton from the January WASDE as an average for the season based on supply and demand considerations. USDA predicted an ending stock of 450,000 tons representing 0.7 percent of supply.

At close of trading on January 12th the CME spot price for soybean meal was $298 per ton, up $3 per ton (1.0 percent) compared to the USDA projection of $295 per ton and down 1.0 percent from the December 9th CME price.

JANUARY 2026 WASDE #667 Projection of Soybean Meal Production and Use

Quantities in thousand short tons

|

Beginning Stocks

|

398

|

|

Production

|

60,752

|

|

Imports

|

725

|

|

Total Supply

|

61,350

|

|

Domestic Use

|

42,025

|

|

Exports

|

19,400

|

|

Total Use

|

61,425

|

|

Ending Stocks

|

450

|

Average Price ex plant: $295 per ton (Down $5 per ton from the December WASDE)

IMPLICATIONS FOR PRODUCTION COST

The price projections based on CME quotations for corn and soybeans suggest higher feed production costs for broilers and eggs. Going forward, prices of commodities will be determined by World supply and demand and U.S. domestic use and exports. The price projections based on CME quotations for corn and soybeans suggest higher feed production costs for broilers and eggs. Going forward, prices of commodities will be determined by World supply and demand and U.S. domestic use and exports.

For each 10 cents per bushel change in corn:-

- The cost of egg production would change by 0.45 cent per dozen

- The cost of broiler production would change by 0.25 cent per live pound

For each $10 per ton change in the cost of soybean meal:-

- The cost of egg production would change by 0.35 cent per doze

- The cost of broiler production would change by 0.30 cent per live pound.

WORLD SITUATION

With respect to world coarse grains and oilseeds the January 2026 WASDE Report included the following appraisals by USDA:-

COARSE GRAINS:

“Global coarse grain production for 2025/26 is forecast up 14.8 million tons to 1.591 billion.

This month’s foreign coarse grain outlook is for greater production, virtually unchanged trade, and higher ending stocks. Foreign corn production is forecast higher with an increase Global coarse grain production for 2025/26 is forecast up 14.8 million tons to 1.591 billion.

This month’s foreign coarse grain outlook is for greater production, virtually unchanged trade, and higher ending stocks. Foreign corn production is forecast higher with an increase for China, where production is raised to a record 301.2 million tons based on the latest data from the National Bureau of Statistics. Foreign corn ending stocks for 2025/26 are higher, mostly reflecting an increase for China. Global corn stocks, at 290.9 million tons, are raised 11.8 million.”

OILSEEDS:

“Foreign 2025/26 oilseed production is raised 2.4 million tons mainly on higher soybean production partly offset by lower cottonseed and rapeseed output. For sunflowerseed, higher production for Argentina is offset by lower production for Russia. Rapeseed production is also lowered for Russia”. “Foreign 2025/26 oilseed production is raised 2.4 million tons mainly on higher soybean production partly offset by lower cottonseed and rapeseed output. For sunflowerseed, higher production for Argentina is offset by lower production for Russia. Rapeseed production is also lowered for Russia”.

“The 2025/26 global soybean outlook includes higher production, increased crush, lower exports, and higher ending stocks. Global soybean production is increased 3.1 million tons to 425.7 million, reflecting higher crops for Brazil and the United States but lower output for China. Brazil soybean production is raised 3.0 million tons to 178.0 million on beneficial weather conditions in the Center West during the peak of the growing season. Further, positive early-season conditions and consistent rainfall in the south of Brazil also bolsters yield prospects, especially compared to previous years when the region faced drought. Soybean crush and soybean meal exports are raised for Brazil and the United States, and pairs with higher soybean meal imports for the European Union. EU soybean crush and soybean imports are lowered on higher imported soybean meal supplies. Global soybean exports for 2025/26 are reduced 0.1 million tons to 187.6 million as higher exports for Brazil are offset by lower U.S. shipments. Global ending stocks are increased 2.0 million tons to 124.4 million, mainly on higher stocks for the United States and Brazil.”

World and U.S. Data Combined for Coarse Grains and Oilseeds:-

|

Factor: Million m. tons

|

Coarse Grains

|

Oilseeds

|

|

Output

|

1,591*

|

693

|

|

Supply

|

1,914

|

835

|

|

World Trade

|

250

|

215

|

|

Use

|

1,592

|

579

|

|

Ending Stocks

|

322

|

145

|

*Values rounded to one million metric ton

(1 metric ton corn= 39.37 bushels. 1 metric ton of soybeans = 36.74 bushels)

(“ton” represents 2,000 pounds)

|

Poland Criticized in E.U. Audit

|

01/07/2026 |

|

Poland has emerged as a significant producer and exporter of table eggs and poultry meat. It is documented that in 2024 Poland exported 245,000 tons of shell eggs corresponding to 338 million dozen. In the same year, Poland exported 2.0 million metric tons (4.4 billion pounds) of RTC mostly to E.U. nations representing 69 percent of total national output. Poland has emerged as a significant producer and exporter of table eggs and poultry meat. It is documented that in 2024 Poland exported 245,000 tons of shell eggs corresponding to 338 million dozen. In the same year, Poland exported 2.0 million metric tons (4.4 billion pounds) of RTC mostly to E.U. nations representing 69 percent of total national output.

Over the past decade, eggs and poultry meat shipped by Poland have been implicated in outbreaks of salmonellosis. The E.U. Health and Food Agency conducted audits that disclosed profound deviations from acceptable practices with regard to prevention of Salmonella infection in flocks and in implementing accepted quality control procedures. The most recent 2024 E.U. Commission audit* recognized some  improvements but clearly criticized authorities in Poland for neglecting their collective responsibility in ensuring an acceptable standard of food safety. improvements but clearly criticized authorities in Poland for neglecting their collective responsibility in ensuring an acceptable standard of food safety.

Defects included failure to follow established HACCP principles in compliance with relevant E.U. regulations to prevent or minimize the risk of Salmonella contamination. The audit disclosed inadequate training of technical personnel at the laboratory and processing levels. In many instances, the Competent Authority represented by state officials in Poland failed to enforce E.U. regulations.

The creditability of the regulatory system in Poland and the reliability of product safety is now in question and will jeopardize future exports. The neglect of E.U. standards leading to outbreaks of salmonellosis among consumers of eggs and broiler meat exported by Poland should serve as a warning to producing nations to intensify programs of control, detection and remediation. The creditability of the regulatory system in Poland and the reliability of product safety is now in question and will jeopardize future exports. The neglect of E.U. standards leading to outbreaks of salmonellosis among consumers of eggs and broiler meat exported by Poland should serve as a warning to producing nations to intensify programs of control, detection and remediation.

*EU Commission- Director General’s Health and Food Safety Report 2024-8029

|

VAL-CO Innovations at the IPPE

|

12/30/2025 |

|

WEEDEN SPRINKLER SYSTEM

VAL-CO, recently appointed as international distributors of the Weeden sprinkler will display the system on their Booth B10021. Weeden Sprinkler Systems was established in 1995 and has remained in the founder family after acquisition by Kevin Weeden in 2003.

The system is design to supplement conventional pad cooling during periods of high temperature. Sprinklers are installed at approximately 24’ intervals down the length of the house located in two rows 12’ from the side walls. The system is operated in conjunction with evaporative cooling pads that should be activated only when ambient temperature exceeds 88 Fº. The Weeden sprinkler system permits delaying the operation of cool cells reducing humidity in the house and saving water.

The Weeden control panel incorporates two separate time clocks to activate the sprinklers that stimulate movement of the flock and contribute to cooling of birds. Specific zones can be selected in the house to operate independently. This permits operation of sprinklers at a higher intensity at the exhaust end of the house where temperatures may be higher than at the air inlet end when houses are operated in tunnel mode. The controller can be pre-programed for flock age and temperature to conform to the biomass in the house and to respond to weather conditions.

Activating the sprinkler system promotes growth by stimulating birds to rise from recumbency on litter and to seek food and water. Droplets on the head and back plumage evaporate subject to adequate air movement, producing an external cooling effect.

Sprinkler intervals commence for a ten second duration at 30-minute intervals and can increase up to a 20-second cycle every seven minutes during extreme heat. At maximum duration of 20 seconds, each sprinkler operated at line pressure above 30psi releases 10 ounces of water covering an area of 500 sq. ft. Again, depending on the critical airflow, the system can release five gallons of water within a 25,000 sq. ft. house per 20 second cycle. Maintaining a high rate of evaporation limits litter moisture since droplets are converted to vapor that is exhausted from the house.

Coarse droplets from the Weeden sprinkler system are approximately 1mm in diameter and approximately 10 times the size of mist particles released by high-pressure foggers. Sprinklers are equipped with check valves to prevent dripping, and all sprinklers start and stop at the same time.

The Weeden sprinkler system has been evaluated by the University of Arkansas, Division of Agriculture Research and Extension. Studies have shown that relative humidity in houses is lower using the Weeden system compared to houses fitted with conventional pads that tend to be overused. This results in reduced water usage and drier litter. In a typical broiler house located in Mississippi, operation of the Weeden system resulted in a 64 percent reduction in water used to an average of approximately 9,000 gallons per cycle with a 5 percent reduction in average in-house humidity at the expense of a 3F increase in average summer temperature within the house. Stimulating feed, and water intake contributed to enhanced growth providing the grower with 0.16 cents per pound higher settlement value over two successive summer cycles compared to controls without Weeden Sprinklers.

The Weeden sprinkler system operated in accordance with recommended parameters in conjunction with evaporative cooling pads could enhance growth and return subject to maintaining appropriate longitudinal air movement through the house.

COMFORT NEST™

With an emphasis on breeder hatchability, increasing the proportion of nest-laid eggs and achieving clean shells are important objectives contributing to hatch and hence profitability. VAL-CO will demonstrate the Comfort Nest™ installation at the IPPE. The double-wide nests with a 19” wide entry are more attractive to hens than conventional single-hole nests, reducing floor eggs.

Eggs roll out gently onto a 5” wide polyethylene side-mounted belt with holes allowing ventilation and contributing to unsoiled eggshells. An optional 5" cloth belt is available depending on customers' preference. Nests are equipped with closers to allowing hens to exit nests but deterring re-entry. This reduces the occurrence of broody hens or low-ranked birds hiding in nests and soiling of pads by hens roosting in nests at night.

VAL-CO Comfort Nests are constructed with heavily galvanized steel including partitions. The system can be installed in houses up to 600’ in length.

The automated Comfort Nest™ system can be supplied with a VAL-CO egg collection table constructed from steel for optimal durability.

MACH 57™ SERIES FANS

Responding to the need for greater efficiency in ventilation, VAL-CO has introduced the MACH 57™ series designed for exterior mounting. Within the MACH 57™ range, VAL-CO offers the 50 Hz models with either 1.5 or 2.0 HP rated at 32,000 cfm with 0.05" swp declining to 25,000 cfm at 0.20" swp. The 60 Hz models range in displacement from 31,200 cfm to 34,100 cfm at 0.05" swp.

All fans are designed for optimal air speed and displacement and are fabricated from galvanized coated steel and constructed with corrosive resistant materials. The MACH 57™ range uses many common components in common with 54" VAL-CO fans to reduce inventory of spare parts.

The MACH 57™ fan is available with a compatible exterior mount with a cone and dampers. The unit is constructed of polypropylene and fiberglass for a long service life. The interior of the mount is coated black to reduce entry of light.

The MACH 57™ series fans can be supplied to operate with voltages ranging from 208 to 230v, 190 to 380v or 208 to 230/460v supply.

SRP® AUX INFRARED BROODERS

VAL-CO will feature SRP® infrared brooders designed for optimal chick comfort to promote growth. The AUX range offered in the U.S. comprises 20 ft. units rated at either 80,000 or 100,00 BTU/hr. SRP® series infrared tube heaters eliminate hot spots over litter and can be ordered with SMART Optizone controllers that allow decentralized zoning, remote monitoring, allowing changes in set points and alerts.

The 20 ft. long radiant tube heaters are endorsed by agricultural engineers affiliated with the UGA Extension Poultry Science Service based on their field evaluation based on even distribution of heat promoting regular distribution of chicks. Temperature variations at litter level are less than 10F in houses. Thermal imaging during brooding provided data supporting the litter-level temperatures located adjacent to outside feeder lines and inside drinker lines.

The University of Georgia extension specialists recommend installing two rows of 20 ft. heaters within 6 ft. of the outer feed lines lengthwise in the brooding area. This arrangement distributes heat evenly over the litter area closer to the sidewalls reducing litter moisture and places the tube heaters closest to incoming cold air from the sidewall inlets. This helps to counteract leakage of cold air through fissures in the sidewalls of older houses.

Further field trials are in progress to evaluate advantages from longer infrared radiant brooders with special reference to fuel consumption, evenness of the flock, feed consumption efficiency and settlement values for flocks.

FUZE® V GRILL-LESS FEEDER PANS AVAILABLE WITH ONCE ILLUMINATION

VAL-CO, will promote the combination of their FUZE feed pan LINES in association with ONCE by Signify Optient lighting. Synergy from the two systems will promote flock uniformity with optimal growth and yield. VAL-CO, will promote the combination of their FUZE feed pan LINES in association with ONCE by Signify Optient lighting. Synergy from the two systems will promote flock uniformity with optimal growth and yield.

The FUZE® V Grill-Less feed pan was designed in cooperation with leading growers. Objectives were to reduce chick mortality and to improve feed conversion efficiency. Features of the FUZE® V include:

- Access to feed in pans from day of placement

- An adjustable collar to regulate feed level according to flock age

- The lip of the pan is designed to prevent scratching and wastage

The Optient lighting system from ONCE by Signify is installed above the feed line to attract broilers of all ages in accordance with natural behavior. Field trials show an improvement in feed conversion of up to four points at the time of harvest. Energy consumption is reduced by up to 70 percent compared to conventional LED ceiling lights. Some growers use only the Optient installation after the end of the brooding period.

The modular LED lights are easy to install using a patented twist-and-hook arrangement.

VAL-CO has been appointed as the exclusive U.S. distributor for the Optient lighting system and can supply installations separately for retrofit or as a combined package.

Valli Baby Area Rearing Aviary

It is universally accepted that rearing aviaries should be compatible with housing of the flock after transfer. Manufacturers of alternative housing systems including Valli of Italy have conducted extensive research and development on brooding systems to ensure that flocks achieve maturity at a uniform weight and time so as to optimize peak and subsequent production.

The Valli Baby Area system will be displayed on the VAL-CO booth. The rearing aviary incorporates design features to facilitate management of replacement flocks. Chicks can be monitored after placement in a single tier. The front grills can be adjusted continuously from closure to complete opening to allow flocks to access litter. The external perches are adjustable in height to conform to the growth of the flock. The Valli Baby Area rearing system offers optimal use of floor space with appropriate positioning of the chain feeder and nipple drinker lines.

Valli offers a range of options with regard to the number of tiers and the flexibility inherent in the system allows retrofitting to existing houses sold, installed and serviced by VAL-CO.

|

Job Elimination at USDA

|

12/26/2025 |

|

Based on news reports of extensive reductions in head count following the activities of DOGE Senator Amy Klobuchar (D-MN), Ranking Member of the Senate Committee on Agriculture, Food and Forestry requested details of staff reductions in March. The report that has now been released, with a delay of nine months, covers the first half of calendar 2025. Based on news reports of extensive reductions in head count following the activities of DOGE Senator Amy Klobuchar (D-MN), Ranking Member of the Senate Committee on Agriculture, Food and Forestry requested details of staff reductions in March. The report that has now been released, with a delay of nine months, covers the first half of calendar 2025.

On January 11th 2025 the USDA had 110,384 employees but by June 14th there were 20,306 fewer. Of this number 15,114 accepted deferred resignation with payment of salaries and benefits through September. After review, 52 job categories regarded as critical to national security were exempted from the reduction in head count. Divisions within USDA that experienced losses included the Agriculture Research Service (23 percent of the total); the National Agricultural Statistics Service (34 percent); the National Institute of Food and Agriculture (35 percent) and the Animal and Plant Health Inspection Service at 25 percent.

Senator Klobuchar reacted to the report released on Monday December 22nd stating, “It as particularly shocking that agencies responsible for assisting farmers in small towns have lost a third of their employees.” She added, “Losing nearly 20 percent of all USDA staff weakens the department’s ability to respond to challenges facing our farmers, leaves our food supply chains more vulnerable to threats like New World screwworm and avian influenza.” Senator Klobuchar reacted to the report released on Monday December 22nd stating, “It as particularly shocking that agencies responsible for assisting farmers in small towns have lost a third of their employees.” She added, “Losing nearly 20 percent of all USDA staff weakens the department’s ability to respond to challenges facing our farmers, leaves our food supply chains more vulnerable to threats like New World screwworm and avian influenza.”

Data on staff reductions was assembled by the USDA Inspector General but the report does not include reductions from mid-year onwards. It is anticipated that attrition will continue given the ill-advised reorganization of USDA with elimination of functions considered irrelevant or undesired by the Administration, especially pertaining to climate change, equal opportunity policies and environmental conservation. Although job cuts extended across all states, Rhode Island, Maryland, Alaska and Vermont experienced disproportionate reductions according to POLITCO.

It remains to be determined how job losses as a result of coercion, disaffection and premature retirement will impact services. Reduction of head count in the Animal and Plant Health Inspection Service and the National Agricultural Statistic Service will have an effect on future planning and implementation of programs to prevent or control plant and animal diseases and to assemble and publish reliable statistical data.

During the first term of President Trump, then Secretary of Agriculture Dr. Sonny Perdue moved a large number of long-term employees in the Economic Research Service and the National Agricultural Statistics Service to Kansas City from Washington DC resulting in extensive resignations, weakening the ability of these critical agencies to conduct research and to issue reports. The justification for the action was allegedly to reduce costs and move personnel closer to the constituency they served. These objectives were an entire fabrication, with informed observers noting that the action was to eliminate experienced personnel who had served through successive administrations but were publishing factual reports that were in conflict with White House beliefs, initiatives and policies, especially in the areas of global warming. In the event the move severely depleted institutional experience and knowledge and did not save money. Mission accomplished.

|

Collapse of Believer Meats

|

12/26/2025 |

|

Believer Meats ceased activities at their Wilson County, NC. plant during mid-December.

The company has deep technological roots in Israel with Dr. Yaakov Nahmias, Professor of Biomedical Engineering at the Hebrew University, serving as the founder and motivator. The company attracted initial VC funding approaching $350 million by 2021. Investors included Archer-Daniels-Midland, Tyson Foods, S2G Investments, Neto Group, the Jeff Bezos Earth Fund and others in the entertainment industry. Believer Meats along with competitors recently received a “no questions” authorization from the Food and Drug Administration with respect to the safety of their technology. The company has deep technological roots in Israel with Dr. Yaakov Nahmias, Professor of Biomedical Engineering at the Hebrew University, serving as the founder and motivator. The company attracted initial VC funding approaching $350 million by 2021. Investors included Archer-Daniels-Midland, Tyson Foods, S2G Investments, Neto Group, the Jeff Bezos Earth Fund and others in the entertainment industry. Believer Meats along with competitors recently received a “no questions” authorization from the Food and Drug Administration with respect to the safety of their technology.

With a budget exceeding $125 million for the Wilson production complex and a market valuation of $600 million Believer Meats generated considerable buzz in the alt-meat space despite a succession of failures among competitors including Eat Just, Upside Foods, Meati and Beyond Meat. The final blow to Believer Meats was the defection of a major backer creating a cash crunch exemplified by the $34 million lawsuit filed by Gray Construction the prime contractor for the 200,000 square foot facility.

Industry observers attribute the failure of the company to aggressive implementation of technology that was not proven for the projected scale of production. Success with 200-liter reactors was not realized with vessels in the 10,000-liter range. Initial production for the plant was projected at 21 million pounds with the possibility of doubling output to reduce the high fixed costs incurred. Believer Meats projected that with scale, theoretically achievable in the Wilson plant, the shelf price of their chicken product could be reduced to approximately $7 per lb. Workers at the facility noted that during the commissioning process, there were considerable problems with equipment preventing initiation of production. Industry observers attribute the failure of the company to aggressive implementation of technology that was not proven for the projected scale of production. Success with 200-liter reactors was not realized with vessels in the 10,000-liter range. Initial production for the plant was projected at 21 million pounds with the possibility of doubling output to reduce the high fixed costs incurred. Believer Meats projected that with scale, theoretically achievable in the Wilson plant, the shelf price of their chicken product could be reduced to approximately $7 per lb. Workers at the facility noted that during the commissioning process, there were considerable problems with equipment preventing initiation of production.

Despite the technical issues encountered by Believer and its competitors, there is considerable doubt as to the demand for lab-cultured meat. In addition, a number of beef-producing states have enacted legislation banning production or sale of laboratory-derived meat products. Other states have imposed strict labeling requirements that would have dampened consumer acceptance in the event of commercial quantities of product becoming available.

There was no outward indications of the perilous financial state of Believer Meats leading to precipitous termination during pre-production commissioning. For weeks management issued self-adulatory comments on progress and persisted with rosy predictions of consumer demand.

The failure of Believer Meats cannot be regarded as a temporary speed bump for alt-meat production. The loss of investment capital will serve as a warning to VC companies willing to place bets on long-shot enterprises that have projected an aurora of sustainability, environmental protection and the possibility of a radical change in production of protein.

|

Court Rules in Favor of Oklahoma Against Defendant Poultry Companies

|

12/26/2025 |

|

Judgment has been rendered against a number of poultry companies operating in western Arkansas and eastern Oklahoma. At issue is contamination of the Illinois River watersheds due to runoff of phosphorus from poultry waste applied to agricultural land. A federal judge ruled that the defendant companies breached the Oklahoma Environmental Quality Code. Accordingly fines ranging from $10,000 to $160,000 were imposed on six defendants involved in broiler and egg production. Judgment has been rendered against a number of poultry companies operating in western Arkansas and eastern Oklahoma. At issue is contamination of the Illinois River watersheds due to runoff of phosphorus from poultry waste applied to agricultural land. A federal judge ruled that the defendant companies breached the Oklahoma Environmental Quality Code. Accordingly fines ranging from $10,000 to $160,000 were imposed on six defendants involved in broiler and egg production.

The case has wound through the legal system for over two decades but recently became the subject of conflict between Gentner Drummond, Attorney General of Oklahoma and Governor Kevin Stitt. The case has wound through the legal system for over two decades but recently became the subject of conflict between Gentner Drummond, Attorney General of Oklahoma and Governor Kevin Stitt.

The judgment requires a remediation program with a Court-appointed Master to review planning and implementation with appropriate monitoring of phosphorus levels in soil and water. Farms will be required to develop new and effective waste management plans. The judgment requires a remediation program with a Court-appointed Master to review planning and implementation with appropriate monitoring of phosphorus levels in soil and water. Farms will be required to develop new and effective waste management plans.

The judgment and mandated remediation suggest alternative methods of disposal of broiler litter and waste from egg-production farms. This implies the future application of available technology including composting and some form of processing to remove phosphorus.

Going forward, a limit of two tons of poultry waste per acre per year has been imposed. In addition the Court imposed a threshold phosphorus level of 120 pounds per acre for land application within the Illinois River watershed as a standard.

|

Brought to you by VAL-CO

|

12/26/2025 |

|

This pre-IPPE edition of CHICK-NEWS is sponsored by Val-CO Industries. In addition to news and available statistics, new products to be released at the IPPE by the Company are detailed.

VAL-CO is committed to innovation through introduction of equipment that benefits producers and integrators. Subscribers can access www.val-co.com for additional information and specifications for the new products as outlined. Company representatives will be present at the VAL-CO booth B10021 to review products and to discuss performance specifications.

|

FUZE® V GRILL-LESS FEEDER PANS AVAILABLE WITH ONCE ILLUMINATION

|

12/24/2025 |

|

VAL-CO, will promote the combination of their FUZE feed pan LINES in association with ONCE by Signify Optient lighting. Synergy from the two systems will promote flock uniformity with optimal growth and yield. VAL-CO, will promote the combination of their FUZE feed pan LINES in association with ONCE by Signify Optient lighting. Synergy from the two systems will promote flock uniformity with optimal growth and yield.

The FUZE® V Grill-Less feed pan was designed in cooperation with leading growers. Objectives were to reduce chick mortality and to improve feed conversion efficiency. Features of the FUZE® V include:

- Access to feed in pans from day of placement

- An adjustable collar to regulate feed level according to flock age

- The lip of the pan is designed to prevent scratching and wastage

The Optient lighting system from ONCE by Signify is installed above the feed line to attract broilers of all ages in accordance with natural behavior. Field trials show an improvement in feed conversion of up to four points at the time of harvest. Energy consumption is reduced by up to 70 percent compared to conventional LED ceiling lights. Some growers use only the Optient installation after the end of the brooding period.

The modular LED lights are easy to install using a patented twist-and-hook arrangement.

VAL-CO has been appointed as the exclusive U.S. distributor for the Optient lighting system and can supply installations separately for retrofit or as a combined package.

|

COMFORT NEST™

|

12/24/2025 |

|

With an emphasis on breeder hatchability, increasing the proportion of nest-laid eggs and achieving clean shells are important objectives contributing to hatch and hence profitability. VAL-CO will demonstrate the Comfort Nest™ installation at the IPPE. The double-wide nests with a 19” wide entry are more attractive to hens than conventional single-hole nests, reducing floor eggs.

Eggs roll out gently onto a 5” wide polyethylene side-mounted belt with holes allowing ventilation and contributing to unsoiled eggshells. Nests are equipped with closers to allowing hens to exit nests but deterring re-entry. This reduces the occurrence of broody hens or low-ranked birds hiding in nests and soiling of pads by hens roosting in nests at night.

VAL-CO Comfort Nests are constructed with heavily galvanized steel including partitions. The system can be installed in houses up to 600’ in length.

The automated Comfort Nest™ system can be supplied with a VAL-CO egg collection table constructed from steel for optimal durability.

|

Valli Baby Area Rearing Aviary

|

12/22/2025 |

|

It is universally accepted that rearing aviaries should be compatible with housing of the flock after transfer. Manufacturers of alternative housing systems including Valli of Italy have conducted extensive research and development on brooding systems to ensure that flocks achieve maturity at a uniform weight and time so as to optimize peak and subsequent production.

The Valli Baby Area system will be displayed on the VAL-CO booth. The rearing aviary incorporates design features to facilitate management of replacement flocks. Chicks can be monitored after placement in a single tier. The front grills can be adjusted continuously from closure to complete opening to allow flocks to access litter. The external perches are adjustable in height to conform to the growth of the flock. The Valli Baby Area rearing system offers optimal use of floor space with appropriate positioning of the chain feeder and nipple drinker lines.

Valli offers a range of options with regard to the number of tiers and the flexibility inherent in the system allows retrofitting to existing houses sold, installed and serviced by VAL-CO.

|

SRP® AUX INFRARED BROODERS

|

12/16/2025 |

|

VAL-CO will feature SRP® infrared brooders designed for optimal chick comfort to promote growth. The AUX range offered in the U.S. comprises 20 ft. units rated at either 80,000 or 100,00 BTU/hr. SRP® series infrared tube heaters eliminate hot spots over litter and can be ordered with SMART Optizone controllers that allow decentralized zoning, remote monitoring, allowing changes in set points and alerts.

The 20 ft. long radiant tube heaters are endorsed by agricultural engineers affiliated with the UGA Extension Poultry Science Service based on their field evaluation based on even distribution of heat promoting regular distribution of chicks. Temperature variations at litter level are less than 10F in houses. Thermal imaging during brooding provided data supporting the litter-level temperatures located adjacent to outside feeder lines and inside drinker lines.

The University of Georgia extension specialists recommend installing two rows of 20 ft. heaters within 6 ft. of the outer feed lines lengthwise in the brooding area. This arrangement distributes heat evenly over the litter area closer to the sidewalls reducing litter moisture and places the tube heaters closest to incoming cold air from the sidewall inlets. This helps to counteract leakage of cold air through fissures in the sidewalls of older houses.

Further field trials are in progress to evaluate advantages from longer infrared radiant brooders with special reference to fuel consumption, evenness of the flock, feed consumption efficiency and settlement values for flocks.

|

MACH 57™ SERIES FANS

|

12/16/2025 |

|

Responding to the need for greater efficiency in ventilation, VAL-CO has introduced the MACH 57™ series designed for exterior mounting. Within the MACH 57™ range, VAL-CO offers the 50 HC models with either 1.5 or 2 HP rated at 32,000 cfm with 0.05" swp declining to 25,000 cfm at 0.20" swp. The 60 HC models range in displacement from 31,200 cfm to 34,100 cfm at 0.05" swp.

All fans are designed for optimal air speed and displacement and are fabricated from galvanized coated steel and constructed with corrosive resistant materials. The MACH 57™ range uses many common components in common with 54" VAL-CO fans to reduce inventory of spare parts.

The MACH 57™ fan is available with a compatible exterior mount with a cone and dampers. The unit is constructed of polypropylene and fiberglass for a long service life. The interior of the mount is coated black to reduce entry of light.

The MACH 57™ series fans can be supplied to operate with voltages ranging from 208 to 230v, 190 to 380v or 208 to 230/460v supply.

|

WEEDEN SPRINKLER SYSTEM

|

12/16/2025 |

|

VAL-CO, recently appointed as international distributors of the Weeden sprinkler will display the system on their Booth B10021. Weeden Sprinkler Systems was established in 1995 and has remained in the founder family after acquisition by Kevin Weeden in 2003.

The system is design to supplement conventional pad cooling during periods of high temperature. Sprinklers are installed at approximately 24’ intervals down the length of the house located in two rows 12’ from the side walls. The system is operated in conjunction with evaporative cooling pads that should be activated only when ambient temperature exceeds 88 Fº. The Weeden sprinkler system permits delaying the operation of cool cells reducing humidity in the house and saving water.

The Weeden control panel incorporates two separate time clocks to activate the sprinklers that stimulate movement of the flock and contribute to cooling of birds. Specific zones can be selected in the house to operate independently. This permits operation of sprinklers at a higher intensity at the exhaust end of the house where temperatures may be higher than at the air inlet end when houses are operated in tunnel mode. The controller can be pre-programed for flock age and temperature to conform to the biomass in the house and to respond to weather conditions.

Activating the sprinkler system promotes growth by stimulating birds to rise from recumbency on litter and to seek food and water. Droplets on the head and back plumage evaporate subject to adequate air movement, producing an external cooling effect.

Sprinkler intervals commence for a ten second duration at 30-minute intervals and can increase up to a 20-second cycle every seven minutes during extreme heat. At maximum duration of 20 seconds, each sprinkler operated at line pressure above 30psi releases 10 ounces of water covering an area of 500 sq. ft. Again, depending on the critical airflow, the system can release five gallons of water within a 25,000 sq. ft. house per 20 second cycle. Maintaining a high rate of evaporation limits litter moisture since droplets are converted to vapor that is exhausted from the house.

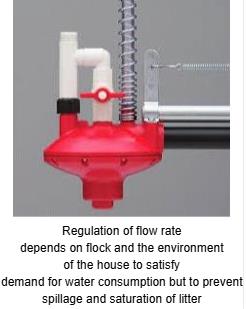

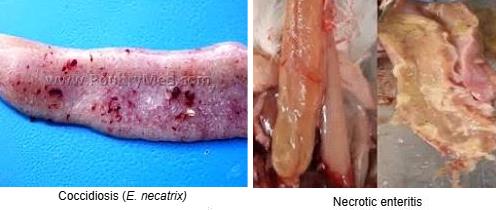

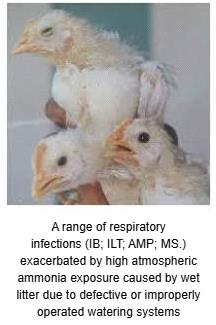

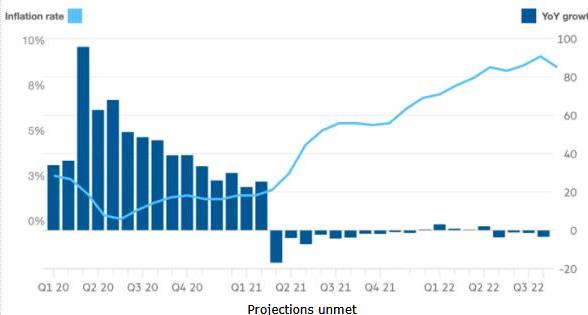

Coarse droplets from the Weeden sprinkler system are approximately 1mm in diameter and approximately 10 times the size of mist particles released by high-pressure foggers. Sprinklers are equipped with check valves to prevent dripping, and all sprinklers start and stop at the same time.