OVERVIEW

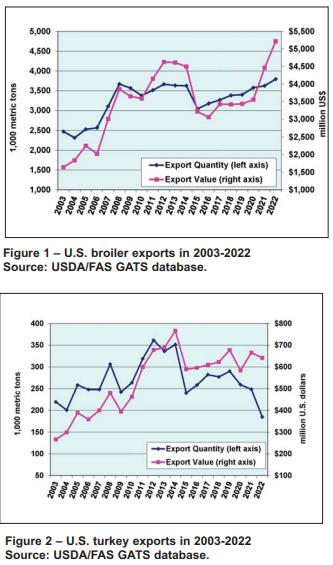

Total exports of bone-in broiler parts and feet during 2022 attained 3,792,380 metric tons, 4.6 percent more than in 2021 (3,624,657 metric tons). Total value of broiler exports increased by 17.0 percent to $5.218 million ($4,459 million 2021).

Total exports of turkey products during 2022 attained 184,837 metric tons, 25.6 percent less than 2021 (248,369 metric tons). Total value of turkey exports declined by 3.6 percent to $642 million ($666 million 2021).

Unit price for the broiler industry is constrained by the fact that leg quarters comprise over 97 percent of broiler meat exports by volume (excluding feet). From the first quarter of 2021 to date, unit value of leg quarters has increased consistent with international demand. Despite the recent increase in unit price for exports, leg quarters represent a relatively low-value undifferentiated commodity lacking in pricing power. Exporters of commodities are subjected to competition from domestic production in importing nations. Generic products such as leg quarters are vulnerable to trade disputes and embargos based on real or contrived disease restrictions.

The outbreaks of African swine fever in China and Southeast Asia from early 2019 onwards coupled with disruptions in chicken production and logistics thereafter due to COVID restrictions, increased demand for protein with international repercussions on trade in chicken and pork. The demand for pork imports to China has diminished as hog production is restored and mild overproduction is evident in the white-feathered broiler sector with implications for exports other than feet during 2033.

EXPORT VOLUMES AND PRICES FOR BROILER MEAT

During 2022 the National Chicken Council (NCC), citing USDA-FAS data, documented exports of 3,822,104 metric tons of chicken parts and other forms (whole and prepared) valued at $5,306 million with a weighted average unit value of $1,388 per metric ton, 11.5 percent higher in unit value than 2021 ($1,244 per metric ton).

The NCC breakdown of chicken exports over 2022 by proportion and unit price for each category compared with the corresponding months in 2021 (with the unit price in parentheses) comprised:-

- Chicken parts 2%; Unit value $1,335 per metric ton ($1,186)

- Prepared chicken 0%; Unit value $3,948 per metric ton ($2,941)

- Whole chicken 8%; Unit value $1,478 per metric ton ($1,244)

The following table prepared from USDA data circulated by the USAPEEC, compares values for poultry meat exports for 2022 compared to 2021:-

|

PRODUCT

|

2021

|

2022

|

DIFFERENCE

|

|

Broiler Meat & Feet

|

|

|

|

|

Volume (metric tons)

|

3,624,657

|

3,792,380

|

+167,723 (+4.6%)

|

|

Value ($ millions)

|

4,460

|

5,218

|

+758 (+17.0%)

|

|

Unit value ($/m. ton)

|

1,230

|

1,376

|

+146 (+11.9%)

|

|

Turkey Meat

|

|

|

|

|

Volume (metric tons)

|

248,369

|

184,837

|

-63,532 (-25.6%)

|

|

Value ($ millions)

|

666

|

642

|

-24 (-3.6%)

|

|

Unit value ($/m. ton)

|

2,681

|

3,473

|

+ 792 (+29.5%)

|

COMPARISON OF U.S. CHICKEN EXPORTS FOR 2021 AND 2022

BROILER EXPORTS

Total broiler parts, predominantly leg quarters but including feet, exported during 2022 as compared with 2021 increased by 4.6 percent in volume and 17.0 percent in value. Unit value was 11.9 percent higher at $1,376 per metric ton.

Broiler imports in 2022 are projected to attain 80,200 metric tons (176 million lbs.) falling to 72,000 metric tons (160 million lbs.) in 2023.

The top five importers of broiler meat represented 52.3 percent of shipments during 2022. The top ten importers comprised 69.7 percent of the total volume reflecting concentration among the significant importing nations.

During December 2022 volume was 4.5 percent lower to 301,632 metric tons compared to December 2021. Value was 16.6 percent lower to $375 million with a 0.2 percent increase in unit value to $1,241 per metric ton.

During 2022 exports of all broiler products to first-ranked (by value) China were 35.9 percent higher by volume to 622,099 metric tons and 26.1 percent higher by value at $1,087 million compared to 2021. Average unit price for all exports to China in 2022 was $1,747 per ton compared with $1,376 per ton for all exports, or excluding China $1,397 per ton, demonstrating the weighting of feet on export value. During December 2022 1st ranked China (by value) imported 38,674 metric tons valued at $63.4 million with a unit value of $1,639 per metric ton

According to USDA statistics during 2022 feet accounted for 77.7 percent of volume at 483,538 metric tons, valued at $0.931 million with a unit price of $1,925 per metric ton. Other broiler products exported to China during 2022 included legs and leg quarters at 17.0 percent of volume with a unit price of $901 per ton. Due to HPAI restrictions monthly volumes of feet have declined by double digits on a Y-O-Y comparison. The USAPEEC note that 37 states with 444 of 577 approved plants and cold storage installations are ineligible to export to China. Other products shipped to China including wings and edible giblets comprising 5.3 percent of volume and 5.5 percent of value at a unit price of $2,862 per metric ton.

During 2022 Mexico was the first-ranked importer by volume with 664,013 metric tons representing 17.5 percent of export volume down 7.3 percent from 2021. Value at $766 million was 14.7 percent of the total for exported broiler products during 2022 and down 8.0 percent from 2021, with a 0.9 percent decline in unit price to $1,153 per metric ton. During December Mexico imported 61,109 metric tons valued at $59.9 million. These values were respectively 8.8 percent higher in volume and 2.9 percent lower in value than in December 2021

During 2022 nations gaining in volume compared to the corresponding period in 2021 (with the percentage change indicated) in descending order of volume were:-

China (+36%); Taiwan, (+46%); Philippines, (+23%); Angola. (+26%); Canada, (+5%); Viet Nam, (+21%); Congo-Brazzaville, (+32%) and Georgia, (+66%);

Losses during 2022 offset gains in exports with declines for:-

Mexico, (-7%); Cuba, (-12%); Guatemala, (-5%); Haiti, (-18%); Colombia, (-22%); Republic of South Africa, (-21%); Ghana, (-34%); Kazakhstan, (-40%).

TURKEY EXPORTS

The volume of turkey meat exported during 2022 decreased by 25.6 percent to 184,837 metric tons from 2021 and value fell by 3.6 percent to $641.6 million compared to 2021 Average unit value increased by 29.5 percent from $2,681 per metric ton to $3,473 per metric ton. Imports of turkey products are projected at 37,270 metric tons in 2022 rising to 38,640 metric tons in 2023.

December 2022 export volume declined 32.9 percent to 13,395 metric tons compared to December 2021. Value was lower by 19.3 percent compared to December 2021 to $50.6 million despite an increase in unit value of 20.3 percent to $3,778 per metric ton.

For the entire year of 2021 export volume declined by 3.9 percent to 249,045 metric tons compared to 2020 but value increased by 14.0 percent to $665 million reflecting a 59.1 percent increase in unit value to $3,321 per metric ton. This trend is apparent in 2022.

During 2022 Mexico was the leading importer of U.S. turkey products with a volume of 129,718 metric tons representing 70.1 percent of volume and 71.3 percent of value at $641.6 million. These values were lower compared to 2021 by 25.5 percent in volume and 3.6 percent in value. Imports by Mexico from Brazil and Chile and disputes with the U.S. over trade issues will complicate future promotional efforts by the USAPEEC

During 2022 only Canada gained in volume compared to 2021 with an increase of 7.0 percent. The 2022 gain was offset by losses in exports to Mexico, (-23%); China, (-33%); Benin/Nigeria, (-46%); Guatemala, (-24%) and Jamaica, (-8%).

PROSPECTS FOR 2023

The February 14th 2022 Livestock, Dairy and Poultry Outlook Report, forecast a 1.1 percent decrease in broiler exports in 2022 to 3.308 million metric tons (7,278 million lbs.) compared to the previous year. For 2023 exports of broiler products were projected to be 3.325 million metric tons (7,315 million lbs.). This value represents 15.6 percent of the projected production of 21.277 million metric tons (46,700 million lb.) of broiler RTC by the U.S. industry.

For 2022, the USDA forecast turkey exports to fall by 25.6 percent to 185,000 metric tons (408,000 million lbs.) representing 7.8 percent of production.

Projected export of turkey products in 2023 will be 181,818 metric tons, (370,000 million lbs.) or 6.7 percent of annual production of 2.527 million metric tons (5,560 million lbs.).

It is important to recognize that exports of chicken and turkey meat products to our USMCA partners amounted to $1,264 million in 2021 and $1,647 million during 2022. It will be important to respect the terms of the USMCA since punitive action against Mexico or Canada on other issues will result in reciprocal action by our trading partners to the possible detriment of the poultry and dairy industries.

The emergence of H5N1strain avian influenza virus with a Eurasian genome in migratory waterfowl in all four Flyways was responsible for sporadic outbreaks of avian influenza in backyard flocks and serious commercial losses in egg-producing complexes and turkey flocks but to a minimal extent in broilers. The probability of outbreaks of HPAI over succeeding weeks appears likely but will be a function of continuous shedding by migratory and domestic birds and mammals. The extent of protection of commercial flocks at present relies on intensity and efficiency of biosecurity, representing investment in structural improvements and operational procedures. To date 3.2 million broilers on 17 farms and in excess of 9.8 million turkeys on 227 farms have been depleted as a result of HPAI.

The application of restricted county-wide embargos following the limited and regional cases of HPAI in broilers with restoration of eligibility 28 days after decontamination has facilitated export volume for the U.S. broiler industry. Exports of turkey products have been more constrained with plants processing turkeys in Minnesota, the Dakotas, Wisconsin and Iowa impacted. Most nations are now eliminating embargos placed on counties and states as the WOAH (OIE) mandated post-decontamination period expires.

The live-bird market system supplying metropolitan areas, the presence of numerous backyard flocks, fighting cocks and commercial laying hens allowed outside access, potentially in contact with migratory and now some resident bird species, all represent an ongoing danger to the entire U.S. commercial industry. The live-bird segments of U.S. poultry production represent a risk to the export eligibility of the broiler and turkey industries notwithstanding compartmentalization for breeders and regionalization to counties or states for commercial production.