Recent press reports relating to the November 2022 Upside Foods premarket consultations with the Food and Drug Administration Center for Food Safety and Applied Nutrition have been misrepresented. The voluntary premarket consultation allowed the Company to present data and a description of their process involving intended production of cell-cultured chicken myocytes.

The FDA accepted in principle the information that the process was consistent with safe manufacturing practices and that the Agency would not require additional information concerning safety. This did not represent an approval of the process or the product.

In terms of the Federal Food, Drug and Cosmetic Act, cell-cultured chicken meat must conform to the same requirements as all other foods.

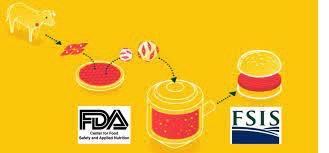

Approval of cell cultured red meat or chicken will be subject to joint approval by the Food and Drug Administration and the USDA Food Safety and Inspection Service. In accordance with a 2019 agreement, these agencies will oversee the production of cultured meat. The FDA will be concerned with collection, differentiation and culture of cells extending through harvest. The FSIS will then be responsible for packaging and distribution, requiring approval from the Engineering, Production and Innovation Center in addition to labels. Both agencies move with glacial speed to write regulations implying that final approval will be years in the future.

In press releases, Upside Foods state that their plant would be “capable of producing 50,000 pounds of finished meat products per year with a future capacity of over 400,000 pounds. To the uninitiated this appears to be a substantial number. In fact if one assumes three pounds of edible meat from a broiler, the initial commercial capacity represents the equivalent of 17,000 conventional broilers harvested at 6.5 pounds. This equates to less than three hours of processing by a single plant with a line speed of 7,000 bird per hour. The projected production by Upside Foods is miniscule against the approximately 165,000 broilers processed each week with a RTC weight of 804 million pounds.

In press releases, Upside Foods state that their plant would be “capable of producing 50,000 pounds of finished meat products per year with a future capacity of over 400,000 pounds. To the uninitiated this appears to be a substantial number. In fact if one assumes three pounds of edible meat from a broiler, the initial commercial capacity represents the equivalent of 17,000 conventional broilers harvested at 6.5 pounds. This equates to less than three hours of processing by a single plant with a line speed of 7,000 bird per hour. The projected production by Upside Foods is miniscule against the approximately 165,000 broilers processed each week with a RTC weight of 804 million pounds.

The question arises as to the capital investment required per pound of cultured meat compared to the equivalent capital cost for conventional broiler meat. The differential will be reflected in depreciation, interest, promotion and overhead, in addition to variable costs including substrate, labor, packaging and maintenance. It is hoped that the assumptions and parameters applied to spreadsheets incorporated in business plans consider the costs and efficiency associated with conventional broiler production.

Even if companies such as Upside Foods can achieve parity in cost and obtain USDA and FDA approval for their product, the major question relates to public acceptance. If plant-based meat substitutes are any indication, initial demand will be high based on a curiosity factor. This is especially apparent among the affluent with a heightened concern for the environment, welfare and sustainability. The only public quoted pure-play plant-meat company is in a precarious financial position and may yet run out of money having survived on capital provided by investors. The Plant Protein Division of Maple Leaf Foods has been consistently unprofitable with declining sales and with no immediate prospect of generating a return on investment in facilities. Plant-based meat alternatives should be more acceptable to a wider range of consumers than cell cultured meat that will be rejected by vegetarians and those concerned over a radical innovation in food production.

Even if companies such as Upside Foods can achieve parity in cost and obtain USDA and FDA approval for their product, the major question relates to public acceptance. If plant-based meat substitutes are any indication, initial demand will be high based on a curiosity factor. This is especially apparent among the affluent with a heightened concern for the environment, welfare and sustainability. The only public quoted pure-play plant-meat company is in a precarious financial position and may yet run out of money having survived on capital provided by investors. The Plant Protein Division of Maple Leaf Foods has been consistently unprofitable with declining sales and with no immediate prospect of generating a return on investment in facilities. Plant-based meat alternatives should be more acceptable to a wider range of consumers than cell cultured meat that will be rejected by vegetarians and those concerned over a radical innovation in food production.

We are indeed in an unfortunate position if writers publishing in food magazines and the mainstream press are incapable of placing an innovative technology in perspective. ‘Puff pieces’ that ignore the realities of production volume and costs, competition and potential consumer demand and are based on self-adulatory press releases are a disservice to readers. Upside Foods and its future competitors will be obliged to continue hyping their technology and prospects to maintain an ongoing stream of investment. Venture capital infusions represent the life blood of start-ups and established non-profitable high-tech companies in the Silicon Valley with most following the dictum of “fake it ‘til you make it”.